Investing.com’s stocks of the week

High Debt Doesn’t Equal Higher Rates

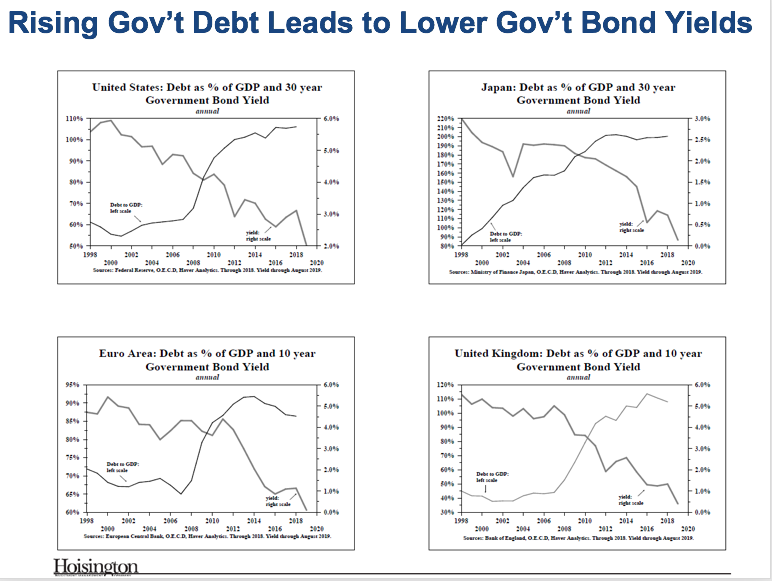

Dr. Lacy Hunt breaks one natural assumption made by investors. You would think that rising government debt levels would lead to higher bond interest rates. Higher debt means higher growth. Higher growth tends to cause higher inflation, and that in turn causes higher short and longer-term rates to compensate and to sell more debt you have to raise the rates to attract investors to absorb it all.

This chart pretty much proves these natural assumptions are false!

Here’s What Happens Instead…

The U.S. accelerated debt as a percent of GDP from 2007 through 2014, and T-bond yields fell from 5% down to 2.5% into 2016 on a two-year lag. Similar for the Eurozone with bond rates falling from 4.5% to 1.0%. Japan has been goosing debt the most from 1998 into 2013 and its bond rates fell from 3.0% to o.7% by 2016 on a 3-year lag. The U.K. was the most extreme in rising debt from 2007 into 2016 with falling rates from 5% down to 0.5% currently.

Here’s what tends to happen instead. Higher government debt tends to lead to “diminishing returns,” or falling ratios of GDP created per dollar of debt, which Lacy later shows has clearly been the case. So, like any drug, it takes more and more to create less effect. Higher debt becomes a greater burden through rising interest and servicing costs – and that slows economic growth.

It also encourages businesses and consumers to over-invest and that excess capacity lowers prices and inflation.

Voila: Another simple insight in a seemingly complex economy.