Three months ago, we identified marijuana stocks as potential winners under a Biden presidency, noting that:

“[r]elative to some of the more liberal Democratic candidates, Biden is seemingly lukewarm toward recreational marijuana, but the prospects of full legalization are nonetheless better under Biden than Trump, especially if the House of Representatives and/or Senate is also under Democratic control. In that case, stocks like Canopy Growth (NYSE:CGC), GW Pharmaceuticals (OTC:GWPRF), Curaleaf (OTC:CURLF), Cronos Group (NASDAQ:CRON), and Aurora Cannabis (NYSE:ACB) could catch a bid…”

While not necessarily unique or profound, this perspective has aged well. At one point on Monday, the “Alternative Harvest” ETF (NYSE:MJ) had surged 33% in less than a week from its pre-election price, and the industry bellwether is still trading up by about 13% from its November 3rd close:

From a technical perspective, MJ has seen its 21-day EMA cross above its 50-day EMA, signaling a possible shift to a medium-term uptrend (though we did see a similar bullish crossover sputter out back in Q2). The RSI likewise reached “overbought” territory above 70 for the first time since June at the start of the week, a bullish sign from a medium-term perspective.

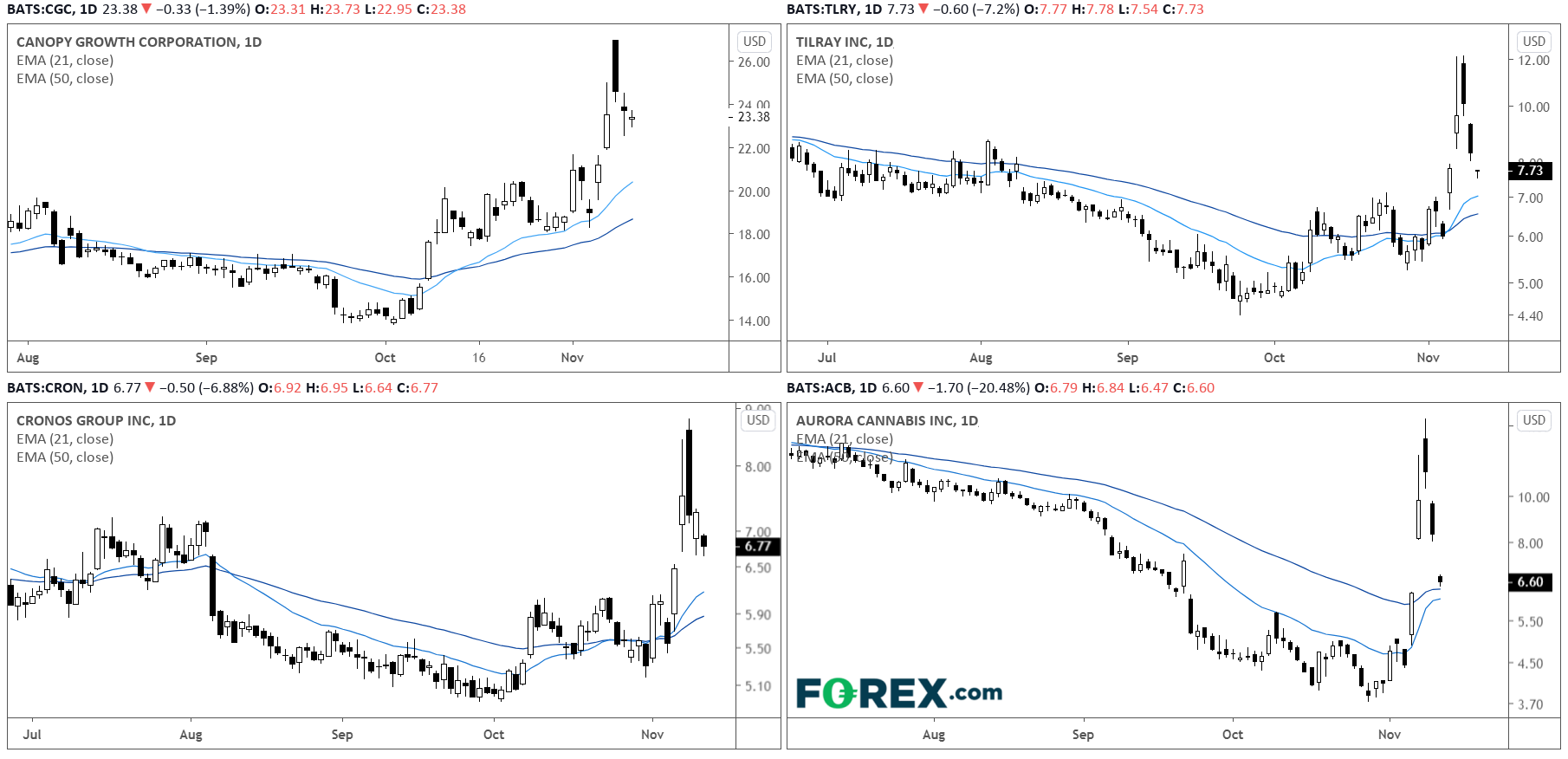

Drilling down into the top holdings, Canopy Growth, Tilray (NASDAQ:TLRY), Cronos Group and Aurora Cannabis (ACB) all saw similar bullish spikes late last week before pulling back so far this week. Moving forward, bullish-inclined traders may want to consider buy entries near the confluence of moving averages if prices continue to pull back, with Aurora Cannabisshowing notably higher volatility than the other top holdings and therefore offering potentially higher risk and reward for traders comfortable bearing that risk.

At the risk of being a buzzkill (pun intended), there’s a risk that these marijuana stocks have gotten ahead of themselves. Though the prospects of federal legalization in the United States are certainly rosier under a Biden Presidency than they would have been under Trump, it’s notable that Democrats will likely not have a majority in the US Senate (pending the results of two runoff Senate elections in traditionally red Georgia), so it may be difficult for Democrats to enact their full agenda. And, even if federal legalization is passed in the coming years, there remains a risk of a “buy the rumor, sell the news” reaction in marijuana stocks.

Unlike the lethargy that its ultimate product produces in users, this nascent industry is surrounded by giddy excitement on the part of investors, so there will likely be plenty of opportunities to capitalize on volatility in both directions in the weeks and months to come, regardless of how the federal legal battle shakes out.