Last Friday ended with a price spike in the EUR/USD which was due not only to the weakening U.S. dollar, but also to speculation around the French presidential elections. Odds are increasing that the centrist technocrat Emmanuel Macron will defeat National Front's Marine Le Pen in the first round of elections. In other words, 'Frexit' risks are fading with Le Pen's chances of winning stagnating, which is currently euro-positive. While speculation around the outcome of the French elections will remain the most important driver of the euro, it is worth noting that the European Central Bank started to slightly move to a less dovish policy stance. While the ECB is not expected to raise interest rates anytime soon, the ECB's tone has cautiously changed from dovish to less dovish.

However, as the euro is mainly driven by fundamental risks, the recent upward trend can quickly come to an end.

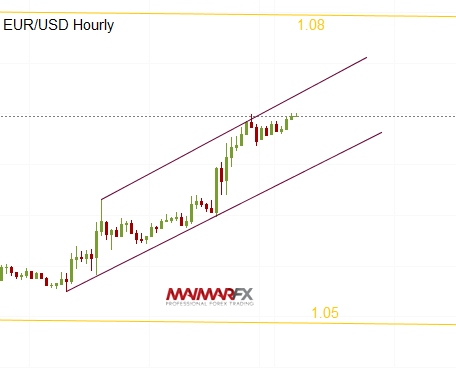

EUR/USD

In the medium-term, we expect the currency pair to trade between 1.08 and 1.05. An upside break above 1.0830 and further 1.0875 would open the door for further gains towards 1.0950 and possibly even 1.1050, whereas a downside break below 1.0450 could increase chances of a move towards 1.0350 and 1.0250.

In short-term time frames however, the focus shifts to 1.0730 on the upside and 1.0650 on the downside.

ECB president Mario Draghi is scheduled to speak in Frankfurt today at 13:30 UTC and his comments could have an impact on the euro.

GBP/USD

Bullish breakout

The cable finally broke above its recent sideways trading range between 1.22 - 1.2130. Whether this bullish breakout will be sustained, remains to be seen. Higher price targets could be at 1.2250 and 1.2275/1.23 now. A significant break above 1.23 could send the pound towards a test of 1.2450. However, if sterling drops back below 1.2170, the recent upswing will be considered as false breakout.

The Bank of England has its March policy meeting on Thursday but no changes are expected. Brexit uncertainty continues to weigh on the pound and it is therefore highly unlikely that the BoE will alter its ultra-accommodative policy.

The main event this week is, of course, the FOMC meeting on Wednesday at which the probability of a Federal Reserve rate hike has soared to 100 percent. Friday's NFP report was strong enough to justify a rate increase this month but the focus will be on the pace of further rate hikes in 2017. Market participants currently expect two to three hikes through the rest of the year.

Here are our daily signal alerts:

EUR/USD

Long at 1.0720 SL 25 TP 30-40

Short at 1.0665 SL 25 TP 20, 40

GBP/USD

Long at 1.2220 SL 25 TP 25, 50

Short at 1.2130 SL 25 TP 20, 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI