This month’s upcoming release of preliminary second-quarter economic data is expected to show an impressive acceleration in growth following Q1’s strong rise in gross domestic product. The update on July 29 will be rightly celebrated as a highlight of America’s continued economic rebound from last year’s pandemic-induced recession.

For the bond market, however, Q2 data is already ancient history and the focus has shifted to the second half of the year. The key question: Will Q2 mark peak growth for the current business cycle? The Treasury market has been edging toward that conclusion by trimming yields in recent months. (Note: the off-the-charts surge in GDP in 2020’s Q3 is technically the peak, but that stellar gain is mostly a function of the initial economic snapback from the extraordinary depths of the pandemic rather than a reflection of “normal” business-cycle activity.)

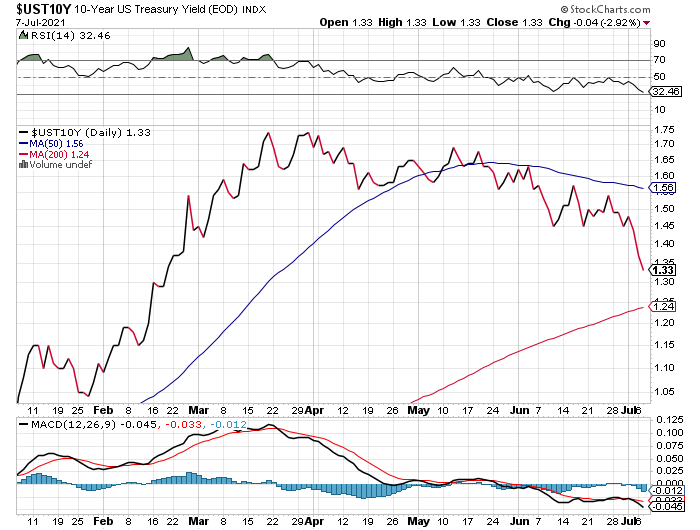

The benchmark 10-year yield continued falling yesterday (July 8), dropping to 1.30% on Thursday, the lowest since mid-February. The market, looking forward as always, is anticipating that economic activity will slow after peaking in Q2.

Softer growth after what’s expected to be a 7%-to-9% increase in real, annualized economic activity in Q2 is hardly a threat. Before the pandemic, the US economy was expanding at roughly a mid-2% trend. By that standard, even if growth slows to 5% in the second half of 2021, the gain will still be in the upper range of the strongest quarterly increases since the 2008 financial crisis.

Recession risk, in short, is nowhere on the near horizon. Rather, the market’s focus is on the crucial question of how quickly and deeply the deceleration unfolds, which in turn will inform how to manage expectations on inflation.

The recent surge in inflation remains the main source of economic and market uncertainty and risk. The debate centers on whether the run-up in inflation is temporary, driven by the economic rebound following the pandemic-driven shutdown? The alternative view is that a confluence of factors will push inflation higher for longer.

The bond market appears open to the transitory inflation narrative. If growth peaked in Q2 and Treasury yields are already slipping, the odds appear challenging for a revival in rates if expectations for softer growth in Q3 and Q4 are accurate.

“The overriding concern being reflected in the bond market is that peak growth has been reached, and the benefits from fiscal policy are starting to fade,” advises Sophie Griffiths, an analyst at the foreign exchange brokerage Oanda, in a research note.

Part of the analysis reflects the recent hint from the Federal Reserve that it’s mindful that if inflation does persist at a higher level for longer, the central bank is prepared to tighten policy. In that scenario, the odds are not trivial that the economy will take a hit. In turn, the allure of bonds will become more attractive, which in turn will drive yields even lower despite rate hikes at the short end of the curve. In other words, a flatter yield curve, and perhaps one that inverts, is a possibility.

In fact, the 10-year/3-month spread has been sliding for several months and is currently 124 basis points — down from more than 170 basis points in March.

The best-case scenario is that inflation proves to be transitory and the Fed isn’t forced to pre-emptively raise rates. But that brings us back to the not-insignificant possibility that economic growth will slow in the quarters ahead, which will provide a tailwind of some degree for bond prices (and keep downward pressure on yields).

As such, the main macro event that will drive the Treasury market for the foreseeable future: getting a handle on how far and how fast growth slows.

Preliminary estimates from various sources are mixed. For example, economists at Wells Fargo currently project that output will rise 8.8% in Q3, down only slightly from the firm’s forecast for a 9.2% rise in Q2. By contrast, Now-casting.com’s latest estimate for Q3 is a substantially softer 5.3% increase.

The future is as uncertain as ever, but it’s a safe bet that monitoring changes in the downside growth bias that may be brewing in the second half will be the main event for markets. The bond market has already placed its opening bets.

“The market may be at a major inflection point,” advises Margie Patel, a portfolio manager at Wells Fargo Asset Management. “There is a feeling that after mid-year the fabulous recovery growth we’ve had will slow.”