As my Slope Plus members can attest, my timing with precious metals has been quite good lately. I offered up a SHORT MINERS recommendation in my Gold………Again?!!? post from February 8th (the symbol is Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST), the triple-bearish-on-miners ETF):

…….and then, after DUST was up 70%, exactly one month later (March 7th) I had an article appropriately entitled One-Hundred Eighty Degrees, which for those of you unacquainted with conversational geometry, meant a totally opposite position of going BULLISH the miners. Today alone, Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG) soared over 30%.

Part of me is honestly thinking, “why bother looking at a thousand charts a day when I could just do occasional trades in leveraged mining instruments and experience these huge windfalls?’ I mean, look, nothing happened today. Yellen’s rate hike had literally a 100% expectancy rate. And yet miners went completely apeshit.

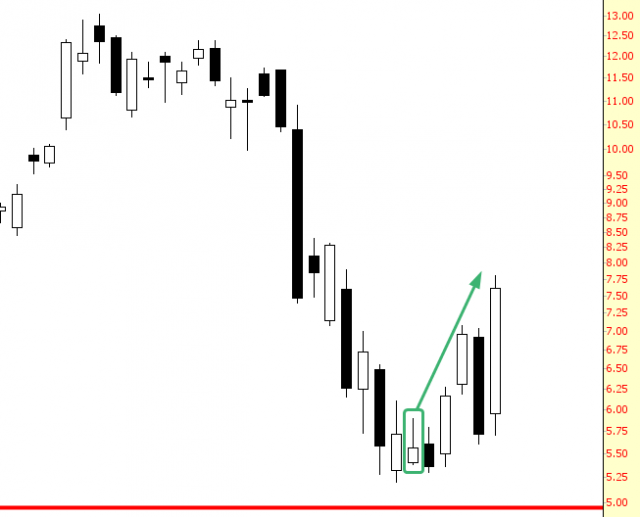

I am, as you might guess, very long GDX (NYSE:GDX) and Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT). How much higher could gold go? Well, none of us know, but looking at the gold and silver sector, I would like to suggest the tinted area below is our “room to roam” to the upside.

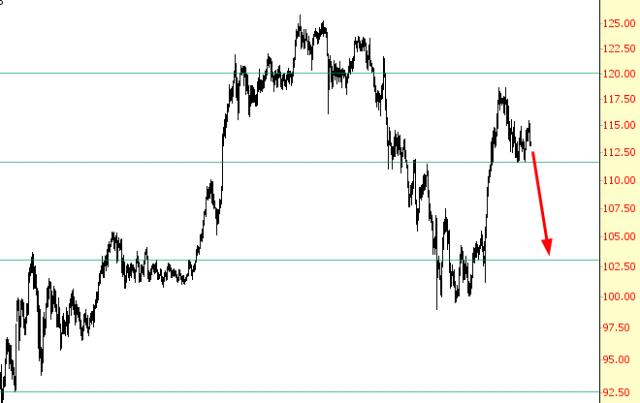

What all it comes down to is one thing and one thing only: the Japanese Yen. If the US dollar can continue to be weak versus the Yen, then gold miners are going to rock the free world. Do you notice how, unlike someone like Gartman, I don’t have to throw arcane words around like “contango” and “oil complex”? It’s simple. USD/JPY goes down……..then miner bulls profit. Period.