The Federal Reserve’s bond-buying program (a.k.a. “quantitative easing”) assuaged the fears of most stock market participants last year. From the fiscal cliff to the sequester spending cuts to the financial crisis in Cyprus, there were few hiccups in the price of the S&P 500. Even after May, when Chairman Bernanke hinted at curbing the controversial policy by the fourth quarter, stock assets kept beating away the short-selling wolves. And the “non-events” did not end there. A possible military strike on Syria? No worries mate. A government shutdown? Nothing to see here.

However, since December 17, 2013, the day before the Fed announced a reduction in its liquidity injections from $85 billion per month to $75 billion per month, the S&P 500 has been relatively flat. The U.S. benchmark closed at 1781 on December 17, worked its way up to 1848 by December 31 as well as January 15, yet closed back at 1781 here on January 27.

Granted, the viability of emerging market currencies is hardly a non-issue for those of us who remember the collapse of the Thai baht in the late 1990s. Back then, the Federal Reserve was able to ride to the rescue with a bailout of an exceptionally influential hedge fund on the wrong side of the currency trade; here in 2014, though, the Fed may not have the same degree of wiggle room.

It is too early to tell if the present pullback will develop into a full-fledged correction of 10%. Nevertheless, prior to the Fed’s tapering decision back in December, it is unlikely that Argentinian currency woes would have registered as a correction catalyst. Remember, last year, investors readily dismissed fears of a run on European banks; they did not even fret the potentially devastating impact of millions of federal employees unable to work.

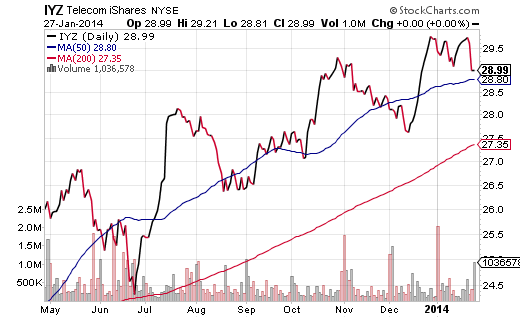

What I find most instructive about the present set of circumstances is the ways in which ETF investors approach the different segments of the economy. In particular, the price on three of the ten core sector ETFs still remain above a short-term moving average: (1) iShares DJ Telecom (IYZ), (2) SPDR Sector Select Health Care, (3) SPDR Select Sector Utilities (XLU). Moreover, each has fallen a shorter distance from its 52-week highs than the other economic sector funds. Finally, two of the three — IYZ and XLU — had not performed particularly well in the rising rate environment that dominated 2013, but they have served as safer havens alongside the decline in long-term interest rates of 2014.

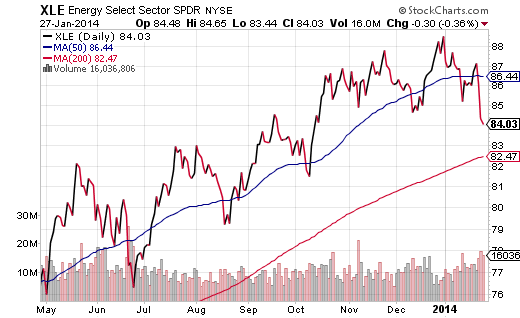

In contrast, there has been a great deal of support for the notion that the U.S. is experiencing a renaissance in manufacturing. And yet, it is the recession-like manufacturing data in China coupled with capital flowing out of other emerging markets (e.g., Turkey, Argentina, etc.) that has caused price declines for cyclical segments like SPDR Sector Select Materials (XLB) as well as SPDR Sector Select Energy (XLE).

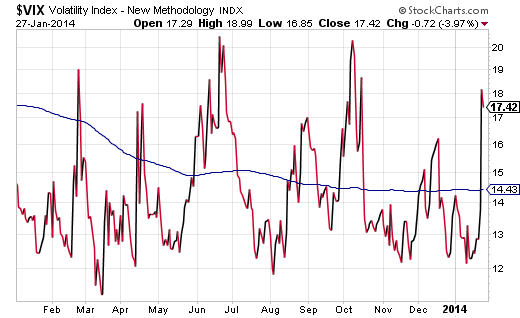

It is impossible to predict the duration or depth of a pullback. The current high-to-low for the broader S&P 500 of 4.2% off of an intra-day top of 1850 is reminiscent of a few scary days in October — when the House of Representatives, Senate and White House shut parts of the federal government down. On the other hand, the current spike in volatility via the CBOE Volatility Index (VIX) shares more in common with the reality of sequestration cuts last February. For sellers to successfully scare off dip-buyers, one would likely need to see the price of the VIX rise above 20 and hold elevated levels for more than a few afternoons.

If there’s one thing that can tip the scales in the direction of a shallow sell-off or a larger corrective period, it may be the market’s reaction to the upcoming Federal Reserve committee meeting. On Wednesday, January 29, the Fed will decide whether to continue tapering its bond purchases incrementally or to suspend an increment based on a number of bad data points. Suspending an increment could frighten stock investors as they try to decipher whether the Fed has lost confidence in the labor markets and the domestic recovery. On the other side, tapering too quickly may hinder emerging market borrowing costs as well as further weaken a variety of currencies, fostering the kind of crisis that market participants have been worrying about over the last week.

Do not expect the true answer to the market’s reaction on the day (1/29) that Bernanke and other committee members announce their decision. In my estimation, the pullback’s severity (or lack thereof) will be understood by Thursday (1/30). A measure of equanimity will have returned or volatility will have kicked up yet another notch. If it’s the latter, stock investors would be wise to seek shelter in places like Utilities (XLU) and Health Care (XLV), while bond investors would likely benefit from a “risk-off” appetite for long-term investment grade bonds in a fund like Vanguard Long Term Bond (BLV).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.