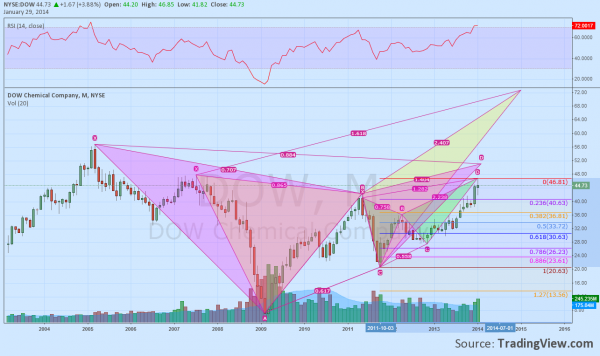

Dow Chemical Company, (DOW) in some ways is like a microcosm of how I see the market. This one monthly chart has so much promise longer term if it can survive the short term. Let me explain. The chart below shows the monthly price action since 2005. For the technical junkie this is nirvana. There are at least 3 harmonics working here. The pink Bat is looking for a move to 51 before any reversal lower. That is currently competing with the green Butterfly that targets a potential reversal now at 46.80. Which one wins out is the determinant of whether it is a trade for now or for the future. I would give the win to the Bat on a move over 47.25. But from there there is also the yellow Deep Crab with a target all the way up at 72. So your longer term upside key levels are 47.25, 51, 56.80 (the 2005 high) and 72.

But the Butterfly is what brings it back to today. Having met the reversal target, a move lower would target 36.81 first and then 30.63. You do not see it in the monthly candle, but it has already seen a pullback through the trigger zone and a move higher. Technically it may already be failing in the reversal lower. A move back over 47.25 would confirm it. I have my finger on the trigger.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.