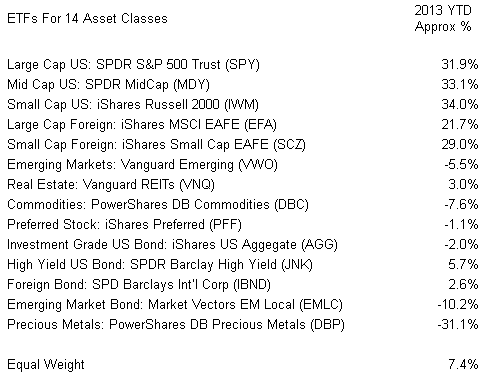

Financial professionals often talk about the importance of diversifying across the asset classes. Had you chosen to do so in 2013, however, you may be feeling less giddy than the “Holy Cow, Look at the Dow” cheerleaders on CNBC.

Granted, as Americans, we tend to be far more ethnocentric in our investing endeavors; we are exceptionally unlikely to invest as many of our dollars in foreign stocks as we are domestic stocks. Similarly, few among us tend to place as much faith in commodities or emerging market bonds as we do mainstream stock assets and mainstream bond assets.

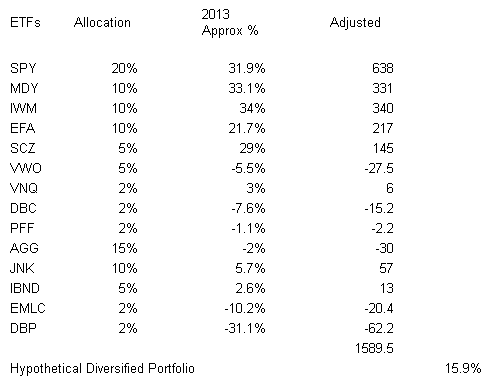

We can imagine a portfolio that accounts for a bias toward the United States as well as a lighter emphasis on non-traditional assets. Even here, the sting of perceived “underperformance” may be difficult for some folks to shake.

In most years, a moderate risk investor might be ecstatic about a total return of 15.9%. Yet here in 2013, skyrocketing U.S. stocks made diversified portfolios about as appealing as gluten-free, veggie crumble pizza.

In truth, successful investing has never been about throwing the most touchdowns in a single season. It is about making rational decisions to achieve the ultimate goal, whether it is financial freedom in retirement, college education for the kids or an estate that provides for loved ones. (Or, in football terms, it’s about winning the Super Bowl.)

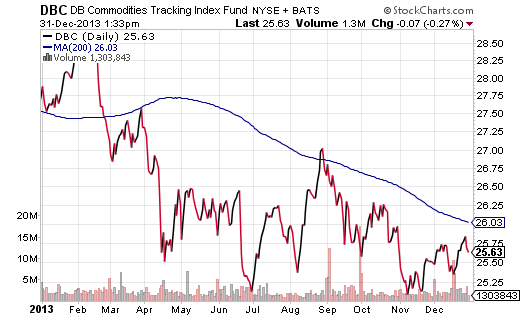

If your diversified ETF portfolio made you feel like a loser in 2013, recognize that feelings are fleeting. The answer for improving performance will not rest in chasing U.S. stocks. On the other hand, you should consider selling some or all of an asset class when the corresponding ETF falls below a long-term moving average. Earlier in the year, exchange-traded vehicles like Vanguard Emerging Markets (VWO), Vanguard REIT (VNQ), PowerShares DB Commodities (DBC), PowerShares DB Precious Metals (DBP) and Market Vectors Emerging Market Local Bond (EMLC) fell below respective trendlines.

Even if you “feel” like you missed your opportunity to sell, dismiss the feeling and utilize the current price. Is it above or below a critical moving average like the 200-day? Sell some or all of the asset class. You can redeploy cash to the asset class when it reclaims an uptrend.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How Diversified ETF Portfolios Can Make You Feel Like A Loser

Published 01/01/2014, 01:59 AM

Updated 07/09/2023, 06:31 AM

How Diversified ETF Portfolios Can Make You Feel Like A Loser

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.