PREFACE

Simply investing in an idea that Walt Disney Co (NYSE:DIS) stock won’t face a serious stock decline has so outperformed owning the stock out-right that it’s almost inconceivable — but these are the facts, and they are not disputed.

To motivate our quick note, here is a chart which shows how a very special risk adjustment in an option strategy has done relative to the stock over the last two-years. The gray curve is the stock return and the highlighted curve is the option strategy.

STORY

Selling out of the money puts is an option investment that has a very clear belief system: The underlying stock simply will not go down a large amount. If that reality exists, the returns can be substantially larger than simply owning the stock.

But, with some care, we can turn that strategy into one with even less risk, and still get the out-sized returns — and that is what we see with Walt Disney Co.

DISCOVERY

Let’s look at selling a put in Walt Disney Co every week. This is not the optimal approach, but it gives a baseline.

That’s a 43.1% return over two-years but there are tremendous risks to this strategy, namely, earnings risk and uncovered downside risk. There’s also a piece that very few people address which is, when do you close the position if its a win?

ANSWERING ALL THE QUESTIONS

First, we can see how this short put strategy is Walt Disney Co did if we eliminated the risk of earnings:

We have totally removed the risk of earnings by simply closing our positions two-days before the event, waiting for it to happen, and then opened the position up again two-days after.

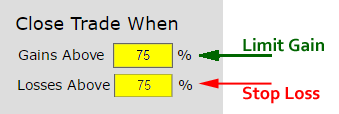

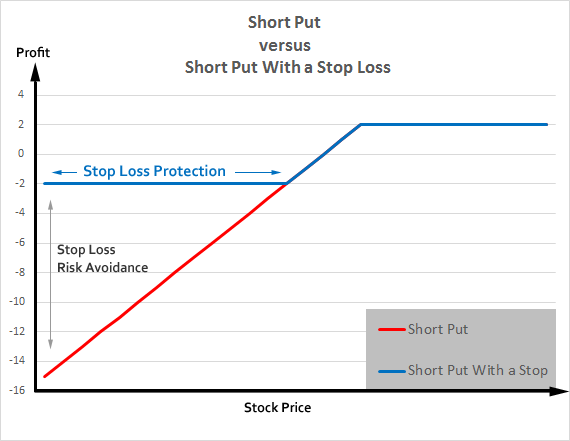

The next risk we need to address is the naked downside risk of a short put. While we’re at it, we need some sort of measurable decision system for when to close the put if its winning. First, we put a stop loss on the short puts and chop the downside off. Here is how that looks:

The profit of a “normal” short put across various stock prices looks like the red line. But, if we put a stop loss on that strategy, we get the blue line. We have effectively removed a substantial part of that downside.

Our last step is to decide when to close our short puts. Our approach will be simple, if we sell a put and it loses 75% of its value — which means the position has gained 75%, we just close it. Putting numbers to it, if we sold a $1.00 option, if it got down to $0.25, we would just go ahead and buy it back for the win.

Testing the effectiveness of this approach is this easy — we do it at the same time as the stop loss:

And finally, here are the results of our very well defined short put strategy:

We took a rather risky 43.1% return, removed the risk of earnings and saw the returns rise to 60.4%, then we finally removed yet further risk with a stop loss, and even put in a strict rule of when to close the trade, and all of a sudden we saw an 87% gain.

Reprising that image from the top of the story — this work has led to an 87% return while the stock has been up just 6.1%.

IT WORKS CONSISTENTLY

What we need to do now is look at this short put over various time periods. We see that it has worked over the last two-years, now let’s look at the last s-x-months:

That 35.9% return compares to a stock rise of 21.6%.

The results aren’t a magic bullet — it’s just access to objective data.

What Just Happened

This is how people profit from the option market — it’s preparation, not luck. To see how to do this for any stock or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Thanks for reading

Risk Disclosure

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.