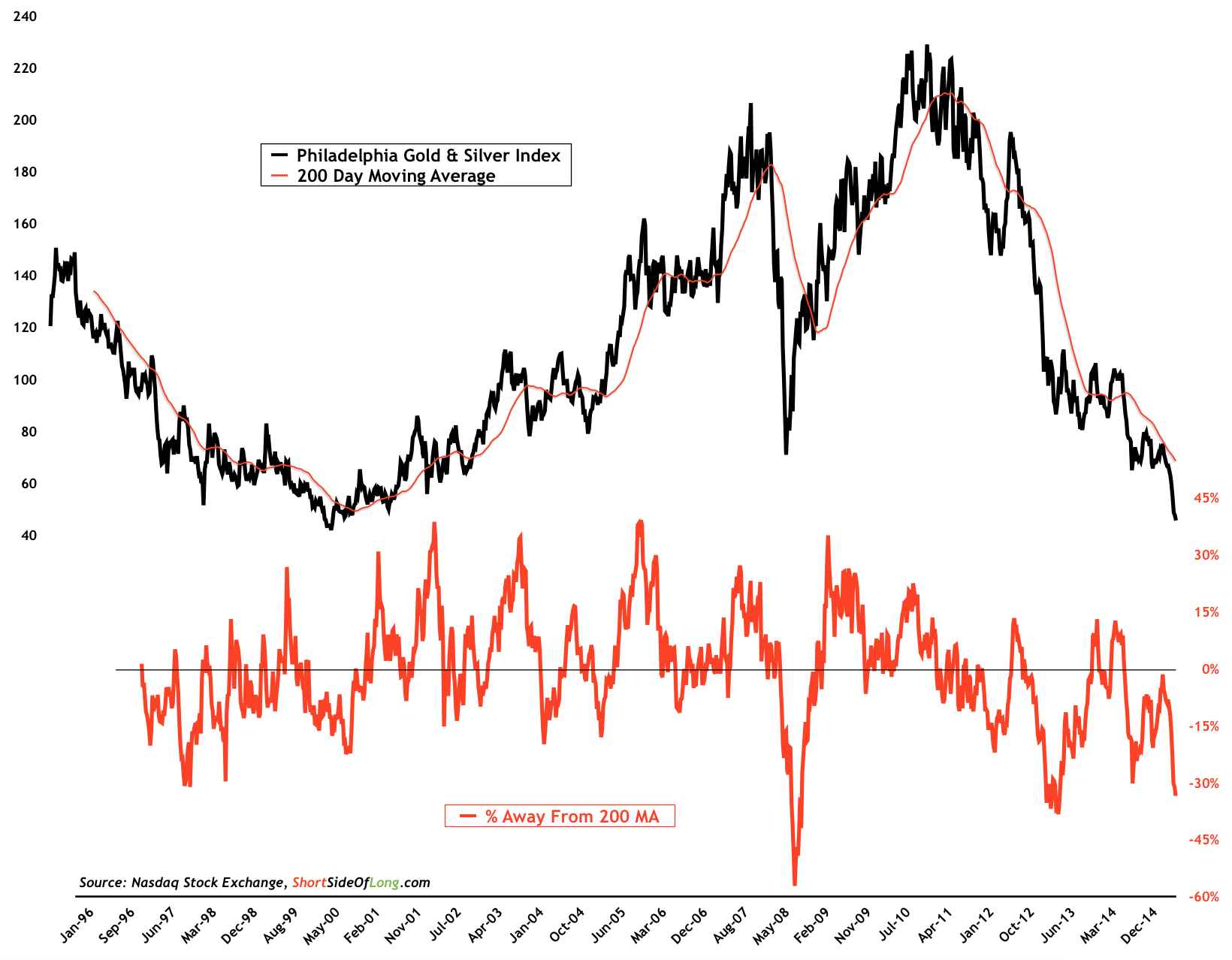

Chart 1: Gold mining companies are trading more than 30% below 200 MA

The current bear market in Precious Metals companies is one of the worst ever in sector history. Prices have declined so much that we have now returned all the way back to the early 2000 bottom. Only a few years ago, if one were to ask gold bulls whether such an event was possible, they would have laughed at you. Miners were seen as very cheap in 2012, 2013, 2014 and also in 2015. Eventually they will become so cheap that a bottom will be formed.

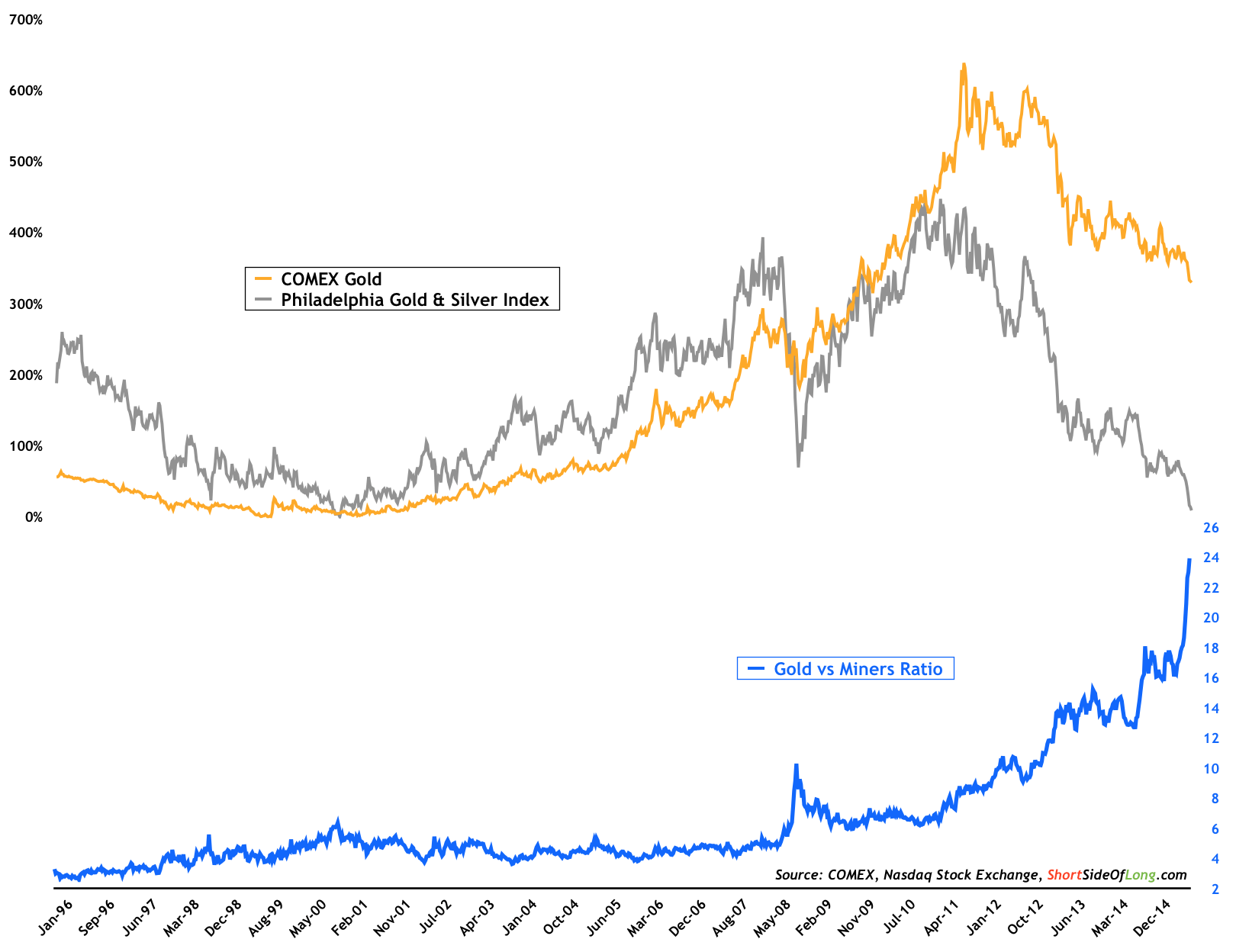

Let us investigate these prices. Technically, gold and silver mining companies are approaching a major support at $41 on the Philadelphia Gold/Silver Index (traded via Market Vectors Gold Miners ETF (ARCA:GDX)). As already explained, this buying zone dates all the way back to the last major bottom.

Furthermore, the index is extremely oversold on a technical basis. Consider that the price of the sector is now over 30% below its 200 day moving average. Such an event only happened 3 previous times in the last two decades. Moreover, on a quarterly performance basis, the price of the index has sold off by 40%. This is a 2 standard deviation event.

Finally, while the sector is oversold nominally, it is under-performing gold in a disastrous way. Let me remind readers that gold (via SPDR Gold Shares (ARCA:GLD)) is still trading around $1,100 per ounce. If we look at the chart below, we can literally see that miners are losing value in a raid fashion on a relative basis. In other words, the ratio between gold and gold miners is going parabolic.