Social media name Snap Inc (NYSE:SNAP) is set to report second-quarter earnings after the market closes this Tuesday, Aug. 7. The stock has a history of making big moves in the wake of its quarterly reports, with Trade-Alert showing an average single-day price swing of 23.9%, regardless of direction, over the past five quarters. This time around, the options market is pricing in a steeper-than-normal 26.3% post-earnings move for SNAP.

In fact, volatility expectations for SNAP are somewhat heightened overall. The equity's 30-day at-the-money implied volatility (IV) of 85.7% registers in the 96th percentile of its annual range, as short-term SNAP options have rarely priced in a steeper IV premium.

And for the most part, options players have been favoring SNAP put options over calls. During the past 10 days, speculators on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 1.10 puts for every call on Snap stock. This ratio arrives in the 96th percentile of its annual range, as traders have rarely purchased puts over calls at a faster clip.

Likewise, Schaeffer's put/call open interest ratio (SOIR) of 1.74 outranks 97% of comparable readings from the past year. This elevated SOIR reveals that puts outnumber calls by a wider-than-usual margin among options set to expire within three months.

Zeroing in on the weekly 8/10 options series that encompasses tomorrow's earnings report, the in-the-money 14-strike put has logged the biggest increase to open interest over the past two weeks, with 10,552 contracts added over this time frame.

On closer inspection, it looks as though many of these weekly 8/10 14-strike puts were bought to open as part of a long put spread strategy on the Snapchat parent. Over the course of last Thursday and Friday's sessions, blocks of these overhead puts traded at the ask price around the same time that smaller blocks (roughly half the size) traded near the bid price on the weekly 8/10 10.50-strike put.

By purchasing the 14-strike puts on SNAP and simultaneously selling the 10.50-strike puts, traders can capitalize on a downside move while also reducing their initial cost of entry -- a balanced approach that can help to offset some of the impact of that ramped-up volatility premium ahead of earnings. Notably, the 10.50 strike corresponds with the site of SNAP's current record lows, set as recently as May.

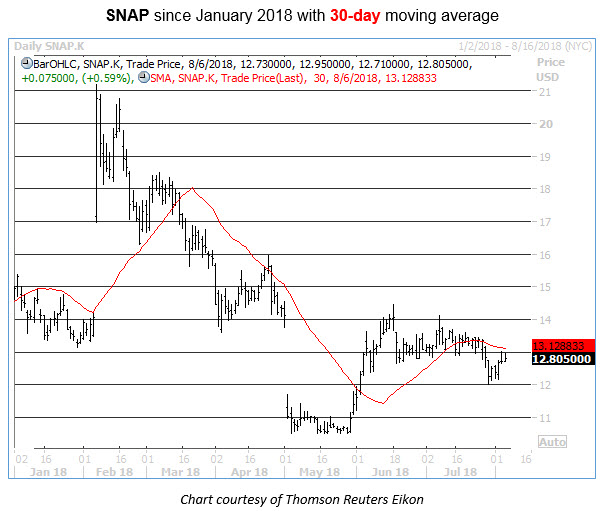

From a technical perspective, SNAP is fractionally higher today to trade at $12.81. The shares have dropped more than 12% this year, and are poised directly below their 30-day moving average -- a short-term trendline that has alternately provided both support and resistance this year. Based on the equity's current perch, an "average" post-earnings swing of 23.9% could carry SNAP as high as $15.87 by Wednesday's close -- or as far south as $9.75, which would represent new all-time low territory.