Monsanto Co. (MON), one of the leading agricultural biotech companies had a great year in 2013. Monsanto sells genetically engineered seed and agricultural productivity chemicals. The chemical company’s stock climbed 20% last year from $95.55 to $116.55. Most analysts believe the bull market of 2013 will continue into 2014 with more modest gains, MON will be one of the first companies to report quarterly financial results in the new year. Monsanto is expected to report their first earnings release of 2014 before the market opens on Wednesday, January 8th.

The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

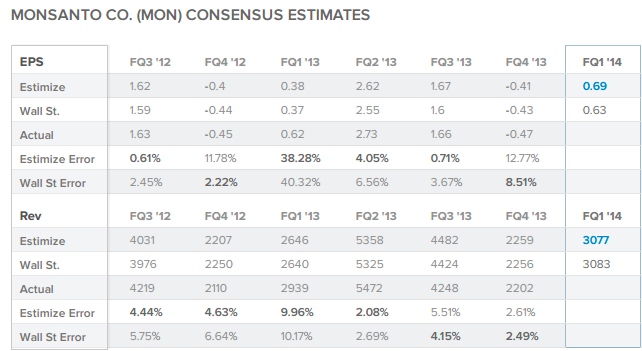

The current Wall Street consensus expectation is for MON to report 63c EPS and $3.083B revenue while the current Estimize consensus from Buy Side and Independent contributing analysts is 69c EPS and $3.077B revenue.

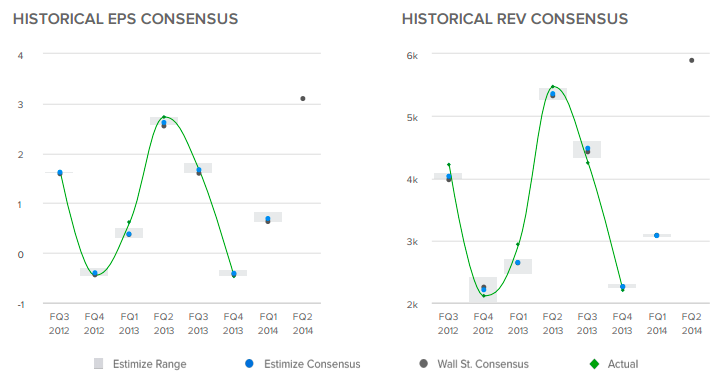

Over the past 6 quarters the Estimize community was more accurate in forecasting Monsanto’s EPS and revenue 4 times each. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, students, and non professional investors Estimize has built a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a large differential between the consensuses.

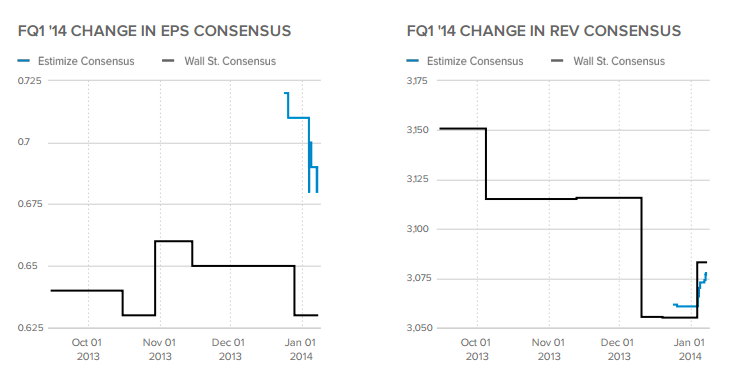

Over the past four months the Wall Street consensus trend for EPS has dipped from 64c to 63c while Wall Street revenue expectations have dropped from $3.151B to $3.083B. The Estimize EPS consensus has declined from 72c to 69c while the revenue consensus has increased from $3.062B to $3.077B at the end of quarter.

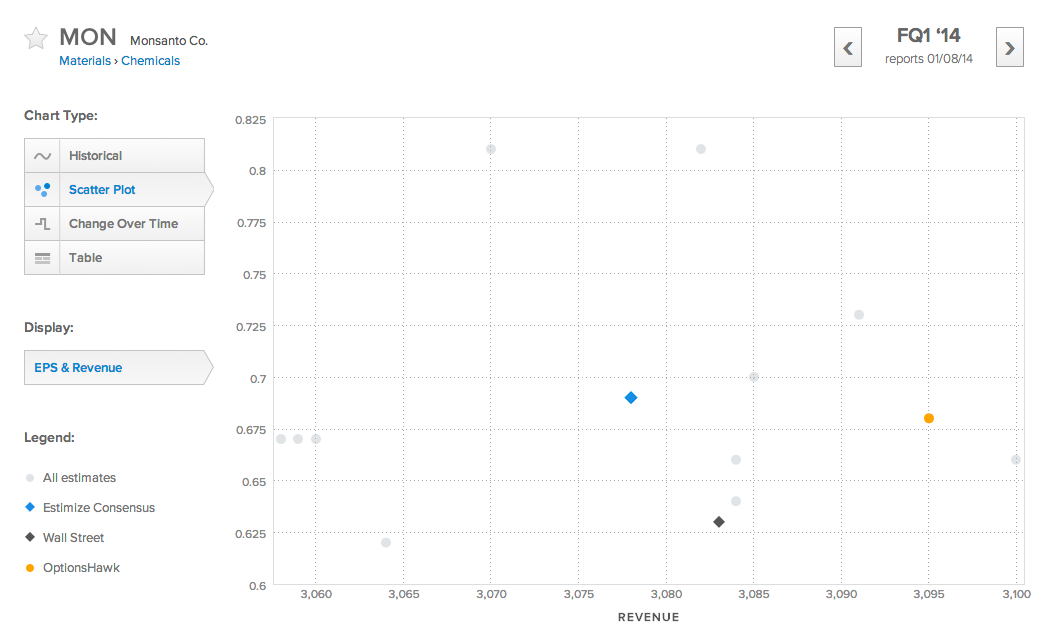

The distribution of estimates published by analysts on Estimize range from 62c to 81c EPS and $3.058B to $3.100B in revenues. This quarter we’re seeing an average distribution of estimates for EPS and a smaller distribution for revenue. The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wider distribution signaling the potential for greater volatility post earnings, a smaller vice versa.

The analyst with the highest estimate confidence rating this quarter is OptionsHawk who projects 68c EPS and $3.095B in revenue. Estimate confidence ratings are calculated through algorithms developed by our deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case OptionsHawk, who is ranked 12th overall among 3400 contributing analysts, is making a bullish call expecting Monsanto to beat the Street on both profit and revenue.

This quarter the Estimize community is expecting Monsanto Co. to beat Wall Street on both the top and bottom line. Throughout the past 6 quarters MON has met or exceeded the Wall Street profit consensus 4 times and the Estimize contributing analysts are expecting them to produce another strong quarterly earnings report.

Get access to estimates for Monsanto published by your Buy Side and Independent analyst peers, and register for free to make your own estimates to see how you stack up to Wall Street by heading over to Estimize now.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How Analysts Expect Monsanto To Report

Published 01/08/2014, 02:42 AM

Updated 07/09/2023, 06:31 AM

How Analysts Expect Monsanto To Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.