As more and more people begin to enter their retirement years they are finding that generating income to fund their expenses can be very difficult. Before 2008, most retirees used a healthy dose of treasury bonds to generate their income. But with interest rates still historically low, the income from treasury bonds is not even keeping up with inflation.

Punished Savers Don’t Know Where To Turn

Savers have been punished in this environment, no doubt about that. Low interest rates have also spawned an entire industry of annuity pitches that almost always overpromise and under deliver due to hidden fees and surrender charges. But so many people are desperate for income in retirement that they can succumb to these pitches.

I want to show just how difficult it has become to cover expenses with just income in retirement if an investor is looking to do this with fixed income. I also want to look at an alternative to this: Using dividend-growth stocks; but not just any dividend-growth stocks. I will analyze how dividend payers with a rich history of dividend growth, even in economic downturns, can help retirees live off of their income in retirement without having to dip into their investment principal.

A Case Study In Income Planning

There are a couple of ways to look at what a person needs to retire comfortably. I have discussed previously how to figure out how much money a person or couple needs saved at retirement so they can easily cover their expenses. Today I want to look at retirement planning in a different way: How does one generate enough income such that they always cover their expenses with that income in retirement.

Let’s step back in time for a moment and look at how much easier it was to live off of the income from bonds in retirement in 2007. This is when the ten year treasury yield was 5%. I want to look at a couple approaching retirement that is currently 55 years old and will retire in 10 years. My assumptions are below.

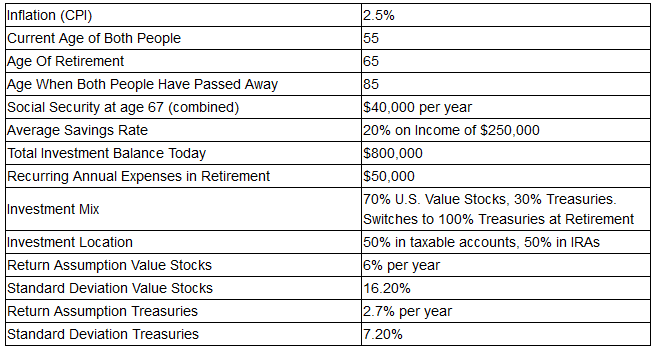

The first thing to note is that this couple plans on switching completely to treasuries when they retire at age 65. This might sound extreme today, but this was common practice just ten years ago. If treasury yields were at the level they were in 2007 this couple would not have any problems. I ran the analysis and graph below using our publicly available Retirement Planner. I assumed they placed all of their investment funds at retirement in 10 year treasuries yielding 5%, which was the 10 year yield in 2007.

You can see in the chart that expenses are covered by income every year in retirement. Not only are their expenses covered by income, but this couple will have nearly $850,000 left at the end of their plan. That is a nice safety buffer to have. It also means this couple is set up for a stress-free retirement. That is a great place to be.

That Was Then, This Is Now

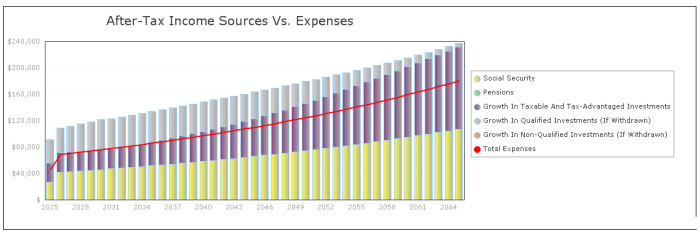

Looking at history is fun, but that doesn’t help us much today. Using today’s levels of interest rates we see the following:

This couple is now in major trouble. They cannot fund their expenses with income in retirement. To add to their woes, their safety buffer (the amount left at the end of their plan) falls to less than $250,000. Also, their probability of success using Monte Carlo analysis, which runs thousands of scenarios to determine the probability of never running out of money, falls to 60% from 97% when yields were higher.

Dividend Growth Stocks To The Rescue

So we know the problem. But what is the solution to their retirement problems? Many investors have turned to dividend-growth stocks that have a solid history of increasing their dividends over time. One of my favorite such stocks is Procter & Gamble (NYSE:PG).

I have recommended for a long time that investors use a combination of high quality dividend-growth stocks and treasury bonds to generate income in retirement. The types of dividend-growth stocks I am referring to are those that consistently raise their dividends and have shown that they can raise their dividends even during recessions. Some other companies that fit this bill are Altria (NYSE:MO), Coca-Cola (NYSE:KO), Exxon (NYSE:XOM), and Johnson & Johnson (NYSE:JNJ).

Please note that I am definitely not recommending that people invest in only one dividend-growth stock. We should all diversify among many dividend-growth stocks that have characteristics similar to Procter & Gamble. I am only using Procter & Gamble as an example for this discussion and I am invested in Procter & Gamble in my own retirement portfolio, along with several other similar dividend payers.

Let’s take a look at what makes companies such as Procter & Gamble such a great investment for retirement portfolios.

| Div. Yield | Div. Growth Rate (3 Yr.) |

Div. Growth Rate (5 Yr. Annualized) |

| 3.2% | 6.6% | 7.5% |

Not only does Procter & Gamble have a dividend yield of 3.2%, but their dividend has been growing at a steady rate of 7.5% over the past five years.

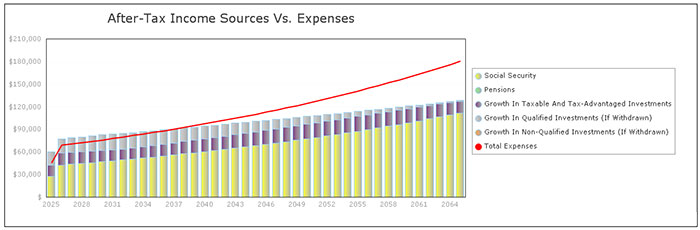

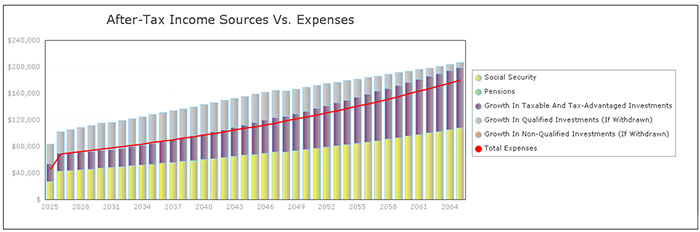

Now let’s see what happens if this couple shifts half of their investments into a basket of dividend-growth stocks that have an average dividend yield of 3%, an average dividend growth rate of 7%, and average stock price growth of 3%.

Now we’re talking. They can easily cover expenses in retirement because of the dividend income being generated by their portfolio. They also now have a safety buffer of over $950,000 at the end of their plan and the probability of plan success jumps to more than 90%.

Income planning is so much harder than it used to be. But with a little bit of research and the right mixture of high quality dividend-growth stocks, those approaching or in retirement can still generate enough income to cover all of their expenses.