Much has been said about the price of oil (NYSE:USO) and Houston. I’ve spoken about it many times so I’ll not go back into it. It comes down to supply. As long as it stays

This is especially so if you own the two most desirable MPC’s in the area, Woodlands and Bridgeland and have (NYSE:XOM) moving 10,000 employees and their families right in the middle of them

My presentation of (NYSE:HHC) for those interested. Harbor 2-11 Final 2.

MLS Report for March 2015

HOUSTON HOME SALES CLIMB IN MARCH, KEEPING INVENTORY LEVELS DOWN

Prices reach March highs as home buyers gobble up new listings

HOUSTON — (April 8, 2015) — After February’s decline in sales volume, Houston home sales returned to positive territory in March, with consumers buying newly listed homes before they ever had a chance to replenish the local housing supply. Sales of single-family homes rose 3.8 percent year-over-year in March, with most activity taking place among homes priced between $250,000 and $500,000. The high end of the market also had a gain after experiencing its first decline in many months in February.

March single-family home sales totaled 6,232 units compared to 6,005 a year earlier, according to the latest monthly report prepared by the Houston Association of Realtors (HAR). Buyer demand offset a 7.3 percent increase in new listings, keeping inventory levels down. Months of inventory, the estimated time it would take to deplete the current active housing inventory based on the previous 12 months of sales, increased only fractionally to a 2.8-months supply. That remains well below the current national supply of 4.6 months of inventory.

Home prices achieved record highs for a March. The average price of a single-family home rose 6.5 percent year-over-year to $276,837. The median price—the figure at which half the homes sold for more and half for less—jumped 8.9 percent to $208,000.

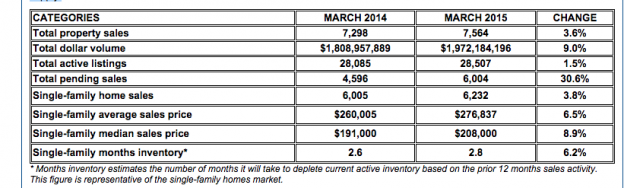

March sales of all property types totaled 7,564 units, up 3.6 percent compared to the same month last year. Total dollar volume increased 9.0 percent to $1.9 billion versus $1.8 billion a year earlier.

“It was great to have sales back in the black in March after February’s decline, but in order to satisfy the long-term needs of the Houston housing market, we need to see substantive growth in inventory levels, which remain at record lows,” said HAR Chair Nancy Furst with Berkshire Hathaway HomeServices Anderson Properties. “It could take the remainder of this year to begin approaching what we consider a ‘balanced market,’ which is typically a five- to six-month supply of homes.”

March Monthly Market Comparison

The Houston housing market grew in all categories in March, with single-family home sales, total property sales, total dollar volume and pricing all up compared to March 2014.

Month-end pending sales for all property types totaled 6,004, a 30.6 percent increase versus one year earlier. Active listings, or the number of available properties, at the end of March rose 1.5 percent to 28,507. New listings totaled 9,389, an increase of 7.3 percent. However, the pace of home buying prevented those new listings from replenishing inventory levels.

Houston’s housing inventory grew only slightly in March to a 2.8-months supply versus the 2.6-months supply of a year earlier. According to the National Association of Realtors, the current supply of homes nationally stands at a more robust 4.6-months supply.