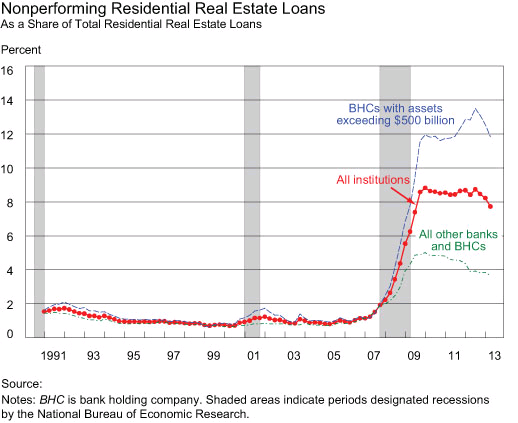

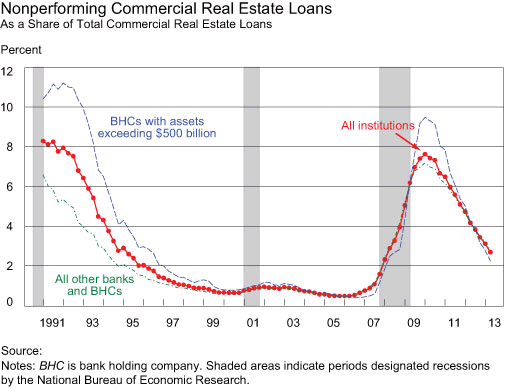

A recent report by the Federal Reserve Bank of New York shows residential non performing loans (NPLs) at bank holding companies remain highly elevated. This is in contrast to the improvement seen in commercial NPLs have declined significantly.

At issue is the impact higher residential NPLs are having on the individual consumer. Economists indicate the wealth effect that results from rising stock and real estate prices has a positive impact on consumer spending. Mark Zandi of Moody's Analytics recently stated, "an added dollar of housing wealth might produce 8 cents in extra spending, and an extra dollar of stock wealth, 3 cents. The overall effect was about 5 cents per dollar of new wealth, Zandi says. Now, 2 or 2.5 cents 'seems more likely to me.'"

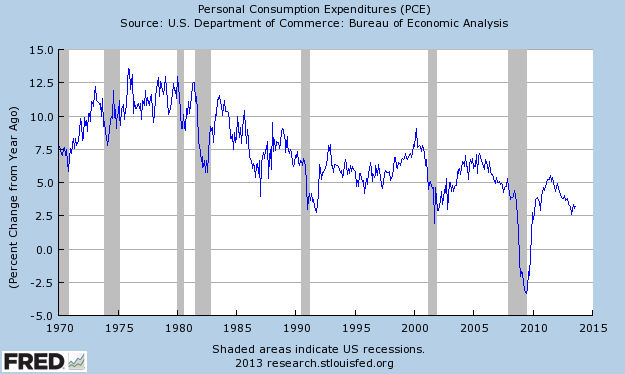

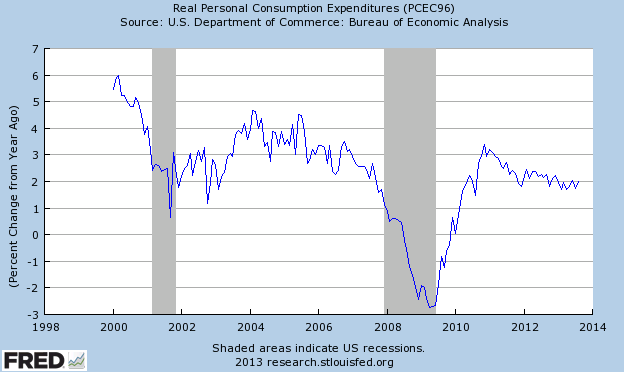

It appears the elevated level of residential NPLs may be showing up in the continually declining rate of growth in personal consumption expenditures (PCE). The first chart below shows the year over year change in personal consumption expenditures and the second shows the same information, but using real PCE.

On top of a potentially struggling consumer sector that is not benefiting from the "wealth effect". The sticker shock associated with the health insurance premiums being realized on the health care exchanges is another headwind for growth in consumer spending. Since consumers account for 70% of GDP, the lack of wealth creation from real estate and fewer dollars to spend as a result of the increased cost of health care via the exchanges, it appears a slow growing economy is likely with us for the foreseeable future.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Housing Issues Continuing Drag On Consumer Spending

Published 10/18/2013, 01:23 AM

Updated 07/09/2023, 06:31 AM

Housing Issues Continuing Drag On Consumer Spending

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.