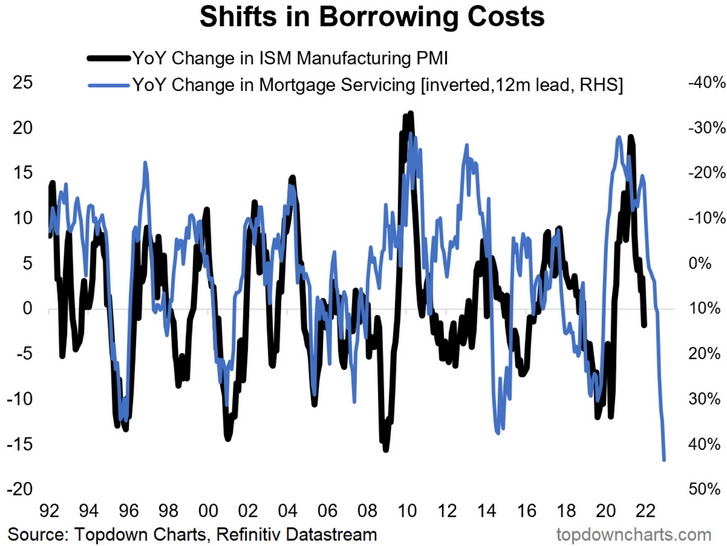

Higher Borrowing Costs for Mortgages: One consequence of the Fed policy pivot is higher bond yields in turn creating higher borrowing costs. The chart below shows just how far US borrowing costs have shifted in recent months (n.b. the change in borrowing costs is shown inverted to align with the direction of the PMI).

The FHA effective mortgage rate ticked up to 3.77% vs the lows of 2.98% early last year. Taking that into consideration along with the rising cost of homes, the indicative mortgage servicing cost indicator has increased by 45% for the USA. That is a very significant rise, and will likely weigh on consumer confidence.

Rising bond yields will also lead to a lower equity risk premium over time, reducing the relative value and attractiveness of stocks vs bonds. But honing in on the chart below, we likely see downward pressure on the PMI — which reinforces our 2022 growth scare scenario thesis. The macro backdrop is steadily shifting!

Key point: Indicative mortgage servicing costs have gone up 45% in the USA.