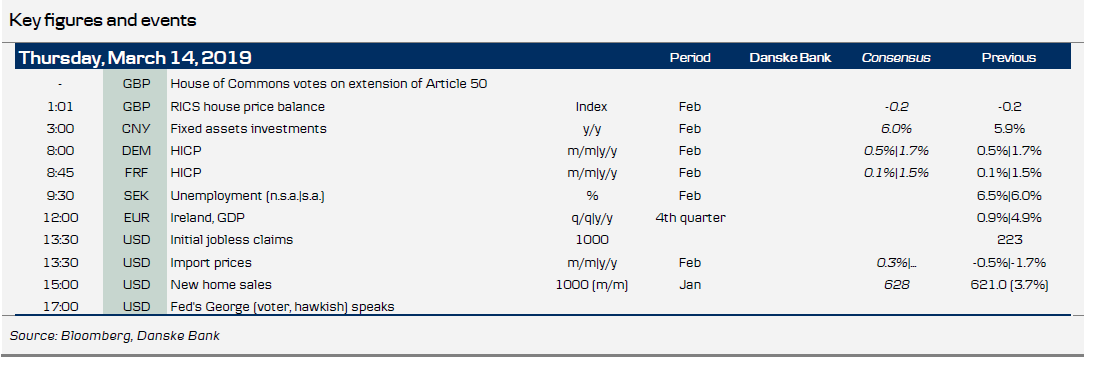

Market movers today

After the UK parliament in yesterday's vote also rejected leaving the EU without a deal, the third and final vote today will show whether the House of Commons can instead converge to agree on asking for an extension of Art. 50 (see also Brexit Monitor: Brexit goes to overtime 11 March). Even if the vote eventually passes, the question remains whether the EU27 leaders will grant an extension and whether it will be a short or long one. According to people familiar with the PM, May said that she will be looking for a two-month extension. Initial comments from the EU's chief negotiator, Barnier, does not seem promising in postponing Brexit.

In the US, we get January new home sales numbers and we will continue to keep an eye on the housing market, since it has begun to show weakness. Higher mortgage rates are probably the driver of this weakening.

In Europe, it is relatively quiet on the data front with final February inflation figures from Germany and France.

In Sweden, unemployment data for February is released and in light of the weakening economy we are expecting the labour market to deteriorate, albeit very slowly.

Selected market news

As expected, the House of Commons rejected a no deal Brexit yesterday. Still, it was quite interesting that a small majority (312 vs 308) voted in favour of a very clear rejection of a no deal Brexit (stronger than what May had put forward). This supports our long-held view that a small majority in the House of Commons will go a long way to avoid a no deal Brexit. We expect the House of Commons to vote in favour of an extension of the Article 50 deadline today but the most important question is whether the EU27 will try to leverage on May's new defeat by demanding a long extension instead of just a short one, which has been our base case so far. We need to follow the response closely ahead of next week's EU summit. Also, it increases the pressure on the Brexiteers, as it is a warning shot that the alternative to May's deal is not a harder/cleaner Brexit but a softer one or perhaps even a reversal.

The reaction in the Asian equity markets to the no-vote has been muted this morning. Focus has been more on the data from the US and China. Retail sales from China were in line with expectations while industrial production was slightly lower. Hence, we have a mixed session with some Asian markets moving slightly lower and others slightly higher.

GBP/USD moved as high as 1.335 late yesterday, but has bounced back towards 1.325 in Asian trade this morning. 10Y US Treasury yields rose modestly by 1-2bp.

Scandi markets

In Sweden, February labour market data is released at 09:30 CET. The Swedish labour market generally remains strong with employment rising at a y/y pace of around 2%. We expect a small uptick in seasonally adjusted unemployment from 6.0% to 6.2% but this is really just a matter of monthly gyration.

Fixed income markets

European long-end curves steepened further yesterday, with France taking the lead pushing 10s30s above 102bp The German curve was also under pressure as 10s30s traded as high as 67bp.

Italy came under slight pressure yesterday, as the market had to absorb heavy supply. The Italian government bond market might continue to trade nervously today ahead of the rating verdict by Moody’s on Friday night. Moody’s downgraded Italy in October last year to Baa3. But importantly, Italy is on a stable outlook and we would be surprised if we have a change from Moody’s in either the rating or outlook tomorrow despite the obvious weaker growth outlook since October last year.

Today, all eyes are once again on the UK after the no deal vote was rejected last night. Everything now points towards an extension, which should support risk appetite and potentially weigh on core markets. Note we published our Yield Outlook last night. We expect 10Y Bund yields to trade close to zero for the rest of 2019. Yield outlook. Rates to stay low for long.

Finally, see our update on the Danish mortgage bond market. We expect DKK17.9bn in social housing remortgaging and issuance of DKK30-40bn in April. Danish mortgage bonds. The remortgaging of the social housing loans.

FX markets

In the majors, EUR/GBP moved (slightly) lower still after May’s new defeat yesterday evening, as the so-called Spelman amendment passed with a narrow majority (312 versus 308). We think an extension of the Article 50 deadline is more or less fully priced in and today’s vote should not have a big market impact on the GBP. Meanwhile, EUR/USD has rebounded above 1.13 on a combination of lower US yields, Brexit news and Eurozone industrial production delivering a ray of light on the hard-tested Euro area economic news front.

Tonight, Riksbank Deputy Governor Henry Ohlsson has a chance to respond to the inflation numbers in relation to a speech at 17:00 CET. If he is concerned, EUR/SEK will go higher. If the significant inflation miss is brushed aside, it could take the cross below 10.50. The money market and EUR/SEK have given the Riksbank the benefit of the doubt: pricing is unchanged and EUR/SEK is lower compared to before Tuesday’s release.