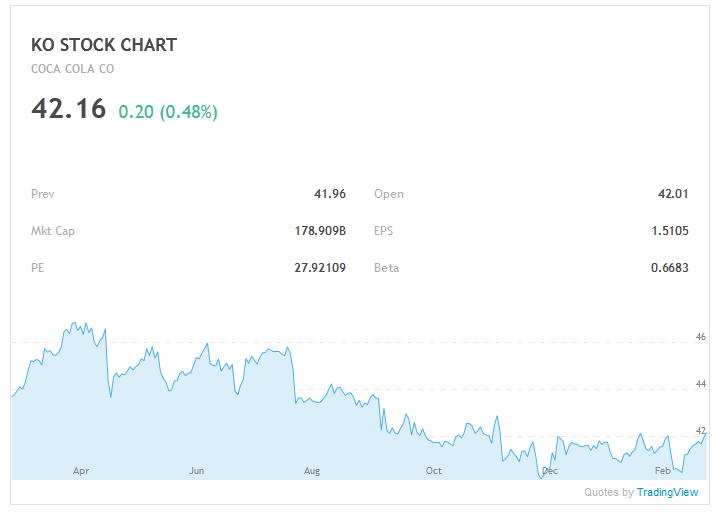

Coca-Cola Company (NYSE:KO) is a befuddling stock. You’ll see a wide range of opinions if you click around the internet today. A casual glance shows a stock whose valuation has suffered a rocky trip downhill during the past year. Industrialized nations seem to be turning up their nose at sweet fizzy drinks. And yet, Berkshire-Hathaway still controls 9.1% of the company with no signs of jumping ship.

With the Coca-Cola Company (NYSE:KO), there’s a lot more to it than meets the eye.

Coca-Cola may not promise the meteoric growth of a revolutionary new business, but its company strength and international presence make it attractive in different ways. Coke’s had a tough year, but that doesn’t mean you should count out KO.

A Deeper Look at Coca-Cola

Coca-Cola was founded in 1886, so long ago that you were still allowed to put frickin’ cocaine (well…coca leaves anyway) in the stuff. Today, Coca-Cola is still known for the brown bubbly sugar water of yore, but about half of their product lineup is composed of “still” beverages, like tea, orange juice, and spring water.

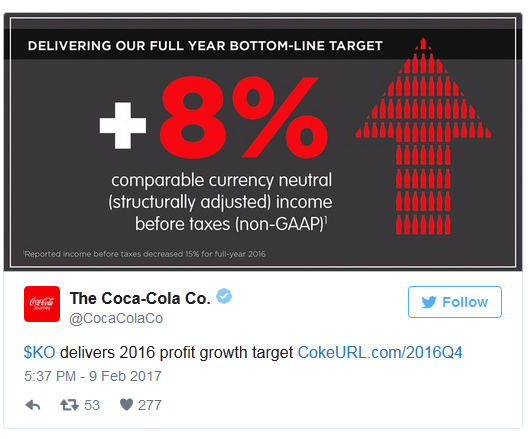

Coca-Cola is not afraid to pivot into new product territories, or to acquire new businesses that are in harmony with their brand. With worldwide revenue of $46 billion and on-hand cash of $22 billion, Coke can make big changes. Their history of rock-solid management makes me optimistic that those changes will be sensible.

Coca-Cola is an American company, and Americans are drinking less soda pop. American habits, however, have little to do with the soda habits of developing nations. Coca-Cola is a nearly ubiquitous international brand with strong presence in more than 100 countries. This, and their increasing investment in non-soda beverages, provides solid long-term growth possibilities.

Coca-Cola’s international revenue has suffered during the past year because of the strength of the American dollar. Revenue earned outside of the country loses value through X/USD exchange rates. The US Dollar’s domination cannot last forever. When things normalize, Coke’s international revenue will benefit greatly.

Perhaps the best thing about owning KO is the dividends. Coca-Cola has increased shareholder dividend distributions annually for 54 consecutive years! In 2017, investors can expect to receive 3.35%, with even greater prospects the longer the stock is held. If KO were to break its dividend streak, this would be be a very bad sign to shareholders. Don’t expect that to happen anytime soon.

Is it Time to Buy $KO?

Yeah, if you want dividends and don’t demand immediate or dramatic returns.

Coca-Cola stock is secure place to park your money. While you own this stock, you’ll benefit from a juicy dividend rate, which you can reinvest or use as income. I also think you’ll see real growth, if you’re willing to wait for expansion and a more hospitable currency situation in the next few years (not months).

Coca-Cola is not going to rocket to new heights, but its value won’t evaporate either. This is because Coke’s already a behemoth. This business will outlive many existing nations. Even at a time of changing consumer preferences and evolving international focus, it’s a great company to own.