In a matter of weeks, funds like the Vanguard FTSE Emerging Markets ETF (ARCA:VWO) surged forward by as much as 8.5%. Do investors suddenly believe that Russia, Brazil and China will collectively get their developing economies back on track? Not necessarily. Is the investing community waking up to the 40% price-to-earnings (P/E) discount for shifting capital into emergers instead of U.S. equities? Probably not. Rather, we may simply be looking at a wave of short-sellers covering their short trades.

Look at it this way: Two of the weakest ETFs over the last ten trading sessions were the iShares Nasdaq Biotech (NASDAQ:IBB) and the Global X Social Media Index (SOCL.O). While valuation concerns may have played a role in the selling pressure, the selling activity on the hottest year-over-year investments is mostly attributable to profit taking. In the same manner, after having pushed prices of emerging markets into the basement, short-sellers have also been taking profits. Previous losers like Russia (iShares MSCI Russia Capped Index (ERUS.K)), Brazil (iShares Brazil Index (ARCA:EWZ)), Turkey (iShares MSCI Turkey (ARCA:TUR)), Columbia (Global X/InterBolsa FTColombia 20 (GXG)) and Thailand (iShares MSCI Thailand (ARCA:THD)) now appear on the 1-month leader board.

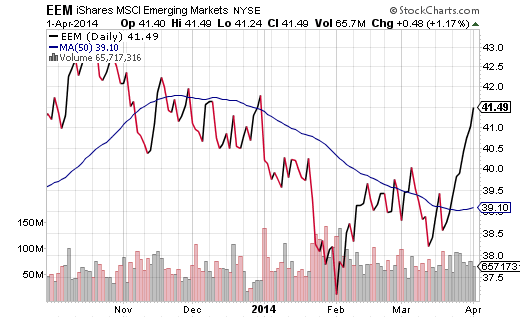

Even though the origin of the upturn may be rooted in hedge-fund short covering, there is some evidence that the newfangled intrigue could be sustainable. The iShares MSCI Emerging Market Fund (ARCA:EEM) raked in $1.5 billion over the last week; $13 billion had left EEM over the previous 12 months. What’s more, contrarians might rally around the fact that Merrill Lynch’s allocation to emerging nations is the lowest that it has ever been.

Indeed, low price-to-earnings ratios are a plus. Limited interest by the herd is also a positive. Even recent technical strength could help kill off a three-year bear for broader emerging market benchmarks.

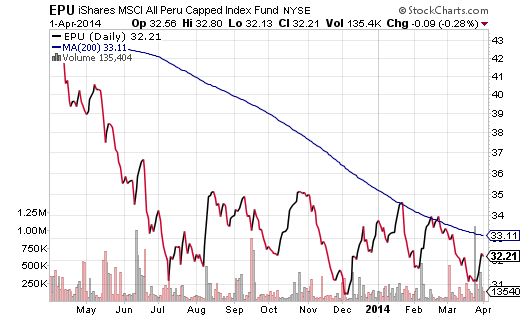

On the other hand, worries that have plagued emerging nations recently have yet to dissipate. Russia is still embroiled in a battle for land with Ukraine. China’s manufacturing continues to slow. Latin American nations from Chile to Peru are still battling a dwindling demand for copper. If those items are not enough cause for concern, there’s always the ongoing fear that the Federal Reserve will completely taper its electronic money creation, reducing the cash that might otherwise be available to bolster emerging economic strength.

My client allocation to emerging economies has been minimal. I did have interest in allocating to the iShares MSCI Philippines Investible Market Index (EPHE.K), but my prerequisite for a purchase did not materialize. If authorities in China actually boost spending to bolster Chinese growth, I may take a second look at iShares MSCI Chile ETF (ARCA:ECH) and the iShares Peru Fund (ARCA:EPU). An allocation to the latter would require a sustained move above its 200-day trendline.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.