Hormel Foods Corporation (NYSE:HRL) is slated to report first-quarter fiscal 2019 results on Feb 21, before market opens. The company has a mixed record of earnings surprises in the trailing four quarters. Let’s see what’s in store for this renowned meat products company this time.

Strong Portfolio to Boost Revenues

Hormel Foods boasts a strong portfolio of renowned brands, which are driving growth. Popular brands like Hormel Black Label bacon, SPAM, Muscle Milk and Wholly Guacamole dips are expected to keep driving revenues. The company is also committed toward making strategic advertisement investments to support growth of brands. Additionally, it focuses on launching products to meet consumers’ preferences aptly.

Acquisitions are another lucrative mechanism through which the company is strengthening its portfolio. To this end, buyouts of Columbus, Fontanini and Ceratti are yielding and are expected to continue boosting performance in the first quarter.

We note that strong brands and effective strategies are aiding steady growth in the Refrigerated Foods and International categories. The trend is likely to continue in the first quarter as well. In fact, the Zacks Consensus Estimate for year-on-year sales growth in these segments for the impending quarter is pegged at 4% and 4.7%, respectively. Also, the consensus mark for revenue growth in the Grocery Products and Jennie-O Turkey Store segments are pegged at 1.3% and 2.3%, respectively.

Such upsides are likely to boost the top line in the upcoming quarterly release. We note that the Zacks Consensus Estimate for the company’s overall net sales is pegged at $2,400 million, indicating an improvement of nearly 3% from the year-ago quarter’s tally of $2,331 million.

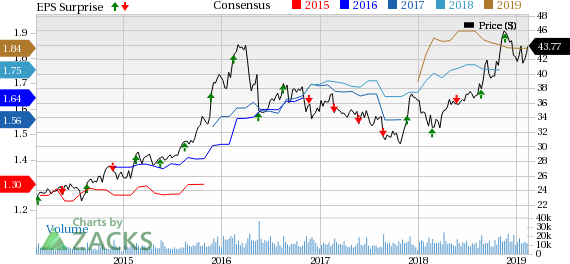

Hormel Foods Corporation Price, Consensus and EPS Surprise

Volatile Market Conditions Pose Worry

Volatile tariff environment for pork is an obstacle for Hormel Foods. Evidently, higher tariffs in core markets weighed on fresh pork export volumes, sales as well as profits in the International division during the fourth and the third quarters of fiscal 2018. The company expects global trade uncertainties to persist as a hurdle for fresh pork exports. Moreover, we note that headwinds in the pork industry compelled the company to sell the Fremont processing facility to WholeStone Farms in December 2018. Further, soft turkey market conditions and higher freight costs are denting the company’s performance since the past few quarters.

Such downsides are likely to impair bottom-line performance in the first quarter. Notably, the Zacks Consensus Estimate for earnings is currently pegged at 43 cents per share, reflecting a decline of 2.3% from 44 cents in the year-ago quarter. This estimate has been stable in the past 30 days.

Zacks Model

Our proven model doesn’t show that Hormel Foods is likely to beat bottom-line estimates this quarter. For this to happen, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Hormel Foods’ carries a Zacks Rank #3, its Earnings ESP of 0.00% lowers expectations of an earnings beat this time. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that they have the right combination of elements to beat estimates.

Nomad Foods Limited (NYSE:NOMD) has an Earnings ESP of +1.45% and a Zacks Rank #2.

Ollie's Bargain Outlet Holdings, Inc (NASDAQ:OLLI) has an Earnings ESP of +0.21% and a Zacks Rank #2.

Turning Point Brands, Inc (NYSE:TPB) has Earnings ESP of +11.11% and a Zacks Rank #2.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

See them today for free >>

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Get Free Report

Hormel Foods Corporation (HRL): Free Stock Analysis Report

Turning Point Brands, Inc. (TPB): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post