Hormel Foods (NYSE:HRL) has quietly assembled a large portfolio of well-known food brands.

The company’s more successful brands include: Skippy peanut butter, Spam, Dinty Moore, Jennie-O Turkey, Muscle Milk, and the recently acquired Applegate Farms.

The Applegate Organics Acquisition

Hormel recently acquired Applegate Farms for $775 million. Applegate Farms is the leader in natural and organic lunchmeat. Applegate Farms is expected to generate sales of around $340 million in fiscal 2015.

This means Hormel is acquiring Applegate Farms for a price-to-sales ratio of 2.3. For comparison, Hormel currently trades at a price-to-sales multiple of 1.6. Other health-conscious publicly traded food companies trade for a price-to-sales ratio of 2 or higher. WhiteWave Foods (NYSE:WWAV) has a price-to-sales multiple of 2.5, and Lifeway (NASDAQ:LWAY) has a price-to-sales ratio of 2.1.

Hormel appears to have paid around fair value for a premium health food brand with the Applegate Farms acquisition. Hormel will leave Applegate to operate as a stand-alone company. Applegate Farms should benefit from Hormel’s larger advertising budget and better supply chain.

Hormel’s Stability & Longevity

Hormel was founded in 1891. Since that time, the company has grown to reach a market cap of $15.3 billion.

Hormel is a very shareholder friendly business. The company has paid increasing dividends for 49 consecutive years, making Hormel a Dividend Aristocrat.

The company currently has a dividend yield of 1.7% and a payout ratio of 36.0%. Hormel’s conservative payout ratio makes it extremely likely the company will continue to pay increasing dividends.

When the company increases its dividend payments in 2016, Hormel well join the exclusive Dividend Kings list – stocks with 50+ years of consecutive dividend increases.

Hormel has a clean balance sheet. The company has $624 million in cash on hand and just $250 million in total debt. Hormel’s sound financial position gives it plenty of ‘dry powder’ to explore further acquisitions and pay increasing dividends.

Hormel performed well during the Great Recession of 2007 through 2009. The company saw earnings-per-share dip slightly from $1.07 per share in 2007 to $1.04 per share in 2008. By 2009, the company was hitting record highs in earnings-per-share. Hormel tends to perform well during recessions because it sells a mix of grocery products. Consumers tend to dine out less and prepare more food at home when the economy is uncertain.

Growth Prospects & Total Return

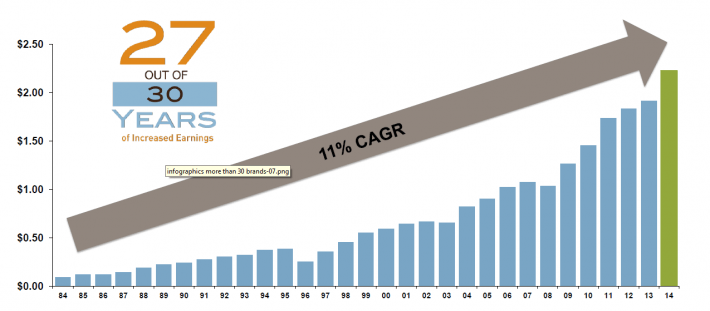

Earnings-per-share grew at 10.5% a year for Hormel over the last decade. The company has grown earnings-per-share in 27 of its last 30 years.

The company has achieved above-average results through organic growth and acquisitions. Growth continued in the company’s 2nd quarter of 2015. Earnings-per-share grew an amazing 29% from $0.52 in the same quarter a year ago to $0.67.

The company realized rapid growth due in large part to lower food input costs. Hormel is expecting earnings-per-share growth of between 12% and 16% for full fiscal 2015.

Hormel has seen especially rapid growth in its international segment. The segment has grown operating profit at 25% a year over the last 5 years. The international segment currently makes up about 8% of Hormel’s total operating profit.

International growth will likely continue to be strong. Hormel’s acquisition of Skippy gave the company a better international presence. The company is leveraging this presence to introduce other brands to international markets.

Going forward, Hormel should continue to grow its earnings-per-share quickly I expect the company’s earnings-per-share to grow at between 9% and 11% a year over the next several years. This growth combined with the company’s 1.7% dividend yield gives investors an expected total return of 10.7% to 12.7% a year, before accounting for valuation changes.

Hormel’s Valuation

Hormel traded for an average price-to-earnings ratio under 20 from 1999 through 2013. Since that time, the company’s price-to-earnings ratio has increased.

Recent success has driven the company’s price-to-earnings multiple higher. Hormel is currently trading at a price-to-earnings ratio of 23.6. This is significantly higher than its historical average.

The price-to-earnings ratios of many of the company’s competitors in the packaged meat and packaged foods industries are shown below:

- Tyson Foods (NYSE:TSN) – price-to-earnings ratio of 16.8

- General Mills (NYSE:GIS) – price-to-earnings ratio of 20.3

- Kellogg (NYSE:K) – price-to-earnings ratio of 17.1

- (JM Smucker Company (NYSE:SJM) – price-to-earnings ratio of 20.0

Hormel has performed better than these companies in recent years. With that said, Hormel is also trading at a substantial premium to its peers.

Hormel appears to be overvalued by 10% to 20% at this time. Potential investors in Hormel should wait to purchase this high quality company at better prices.

Final Thoughts

Hormel is a very shareholder friendly business. Next year, it will hit the 50 consecutive years of dividend increases milestone.

The company’s high quality brands give it a lasting and durable competitive advantage. The evidence for this is the company’s impressive earnings and dividend growth streaks.

Hormel is a low-risk business. The company should continue to prosper as long as consumers demand packaged food products; this should be a very, very long time.

The one real risk to owning Hormel stock is the company’s high valuation. If it were trading under a price-to-earnings ratio of 20, it would be a strong buy. At current prices, it appears slightly overvalued. Hormel is certainly a hold at this time, but investors looking for exposure to the packaged food industry should look elsewhere.