Markets ended near their session highs in a day of high volatility. Investors are still remaining optimistic a debt deal will be reached in the United States before October 17.

Markets started in negative territory as they went from plus to minus and back to positive territory as Congressional leaders spoke and met and as of right now have not agreed on a deal to raise the debt limit or open the government. However, statement from Congressional leaders and the White House are saying a deal is close.

STOCKS

The Dow Jones managed to rise 64 points to end the day at 15,301.26. We are still trading below 15,500 which is needed to end downside pressure to visit 14,700 or lower. The S&P 500 was up a marginal 6.94 points to finish at 1,710.14 and the Nasdaq Composite was up 23.40 points to close at 3,815.27.

The Nikkei 25 resumed trading after being closed yesterday as it finished higher. The yen weakened to a two week low and was t $98.69 at one point against the Dollar.

The Shanghai Composite lost a marginal 0.1 percent as investors are waiting on China to release its Q3 GDP report. The Australian S&P/ASX rose above 5,260 as it has now hit its highest level since September 30. The Kospi rose today as well as offshore buying supported shares.

CURRENCIES

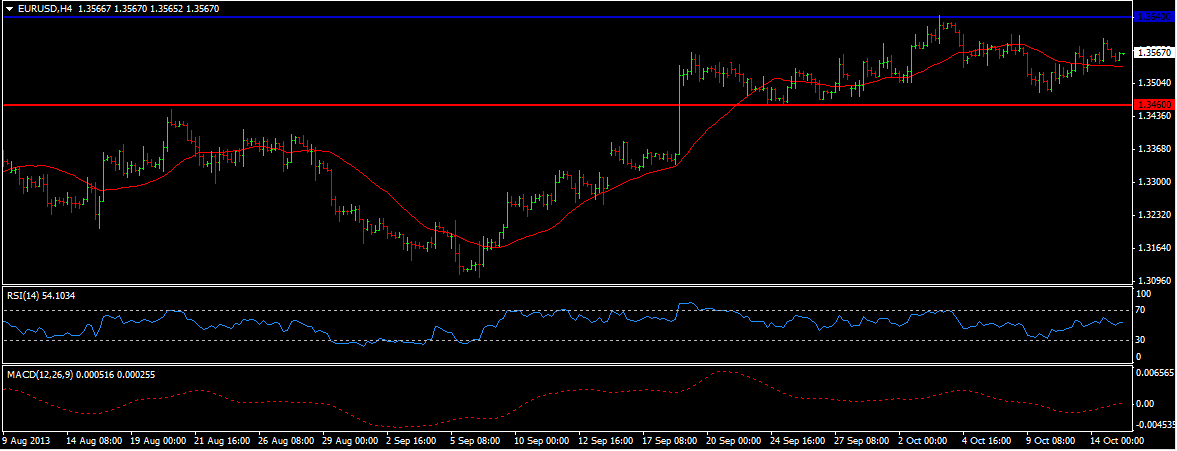

The EUR/USD (1.3566) has fallen but remains range bound. We are still bullish for 1.36500 and then 1.3700. Please see the below chart.

The GBP/USD (1.5991) is continuing to fall as the Dollar sees some strength. We have key support at 1.5900. If that hold we should move back to 1.6000. The USD/JPY (98.427) has seen the Yen weakening a bit. We have support at 98.4000 and if it holds we can retest 100.00.

COMMODITIES

WTI Crude (102.22) has moved higher but we are still just above the support at 100.00. If that keeps holding we will target 103.00. Copper (3.294) rose back above 2.275 and is targeting 3.400 if it rises above 3.300.

Gold (1272.50) is quiet right now but still bearish for 1250. If that breaks we can target 1225. We will be watching the U.S. Congress closely as we near Oct.17 debt deadline.

TODAY’S OUTLOOK

Still no deal regarding the deadlock in the U.S. budget and debt ceiling. There are hopeful statements, but a resolution is needed in two days. Today is a quiet data day. We are waiting on China to release its GDP number for the third quarter and the U.S. will release its Empire State Manufacturing Survey.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hope Sends Markets Higher: No Deal Yet

Published 10/15/2013, 05:49 AM

Updated 05/14/2017, 06:45 AM

Hope Sends Markets Higher: No Deal Yet

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.