Honeywell International Inc. (NYSE:HON) recently announced that it has inked a deal to acquire leading supply chain and warehouse automation company, Intelligrated from an unnamed company backed by funds from private equity firm, Permira, for $1.5 billion.

The company expects the transaction to close by the end of the third quarter. On completion, Intelligrated will be part of Honeywell's Sensing and Productivity Solutions (S&PS) unit in its Automation and Control Solutions business.

About Intelligrated

Based in Mason, OH, Intelligrated is a material handling automation and software engineering company. It operates across the United States, Canada, Mexico, Brazil and China, and employs over 3,100 people. Intelligrated has grown at a CAGR of approximately 13% over the past three years, well ahead of the overall industry. The company boasts of a fairly large customer base worth more than $5 billion and includes the likes of leading Fortune 500 retailers, manufacturers and logistics providers worldwide, top consumer product companies, 30 of the top 50 U.S. retailers, and half of the top 100 Internet retailers.

Benefits from the Deal

The deal is worth 12 times Intelligrated's estimated 2016 EBITDA, while the company expects its sales for 2016 to be approximately $900 million.

Intelligrated's leading supply chain automation solutions will boost Honeywell's portfolio going forward. Intelligrated’s management expertise will further help Honeywell expand its presence globally.

Honeywell’s Business

Based in Morris Township, NJ, Honeywell is a global diversified technology and manufacturing company with a wide range of aerospace products and services. The company is a global leader in refrigerants, aerosols, and foam-insulation blowing agents that are used to replace ozone-depleting Chlorofluorocarbon and Hydro Chlorofluorocarbons. These products also improve the energy efficiency of homes, appliances, and commercial refrigeration systems. Honeywell is engaged in manufacturing, sales and service, research and development activities, mainly in the United States, Europe, Canada, Asia and Latin America. Since the company has a significant exposure in Europe it might face risks related to the Brexit referendum.

The company’s Automation and Control Solutions business wing provides environmental and combustion controls, sensing controls, security and life safety products and services, process automation and building solutions and services for homes, buildings and industrial facilities.

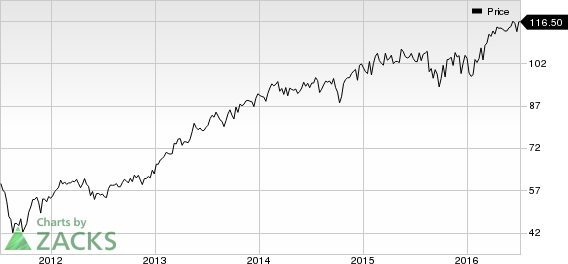

Honeywell carries a Zacks Rank #2 (Buy). Some other favorably ranked stocks include Carlisle Companies Incorporated (NYSE:CSL) , Leucadia National Corporation (NYSE:LUK) and China Merchants Holdings (International) Company Limited CMHHY. All three stocks carry the same Zacks Rank as Honeywell.

HONEYWELL INTL (HON): Free Stock Analysis Report

LEUCADIA NATL (LUK): Free Stock Analysis Report

CARLISLE COS IN (CSL): Free Stock Analysis Report

CHINA MERCHANTS (CMHHY): Free Stock Analysis Report

Original post

Zacks Investment Research