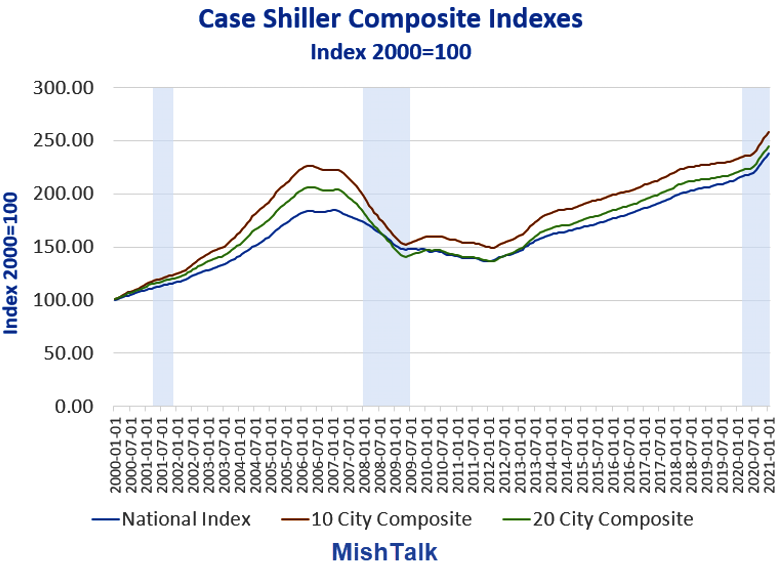

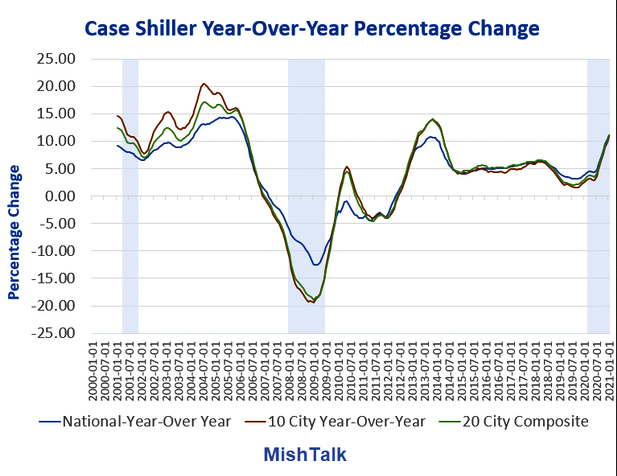

Year-over-Year prices are up 11.19%. That's the highest annual rate of growth since February 2006.

Home Prices Year-Over-Year

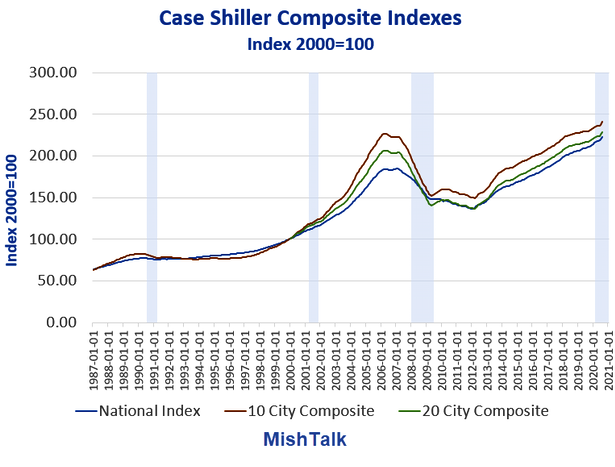

Let's step back a bit to see when and how these bubbles started.

Home Prices 2000-Present

Note the acceleration in home prices that started in 2000.

It reflects then Fed Chair Alan Greenspan goosing the stock market over Y2K fears, then accelerating the bubble with low interest rates fueling the housing bubble that collapsed in 2006.

Fed Chairs Ben Bernanke, Janet Yellen, and now Jerome Powell all employed the same tactics to goose housing and the stock markets.

In Search Of Inflation

Powell wants inflation. He cannot see what is right in front of his nose. But the Fed does not consider home prices as inflation.

I will do a follow-up to this post calculating real interest rates which are behind the booms and the busts.