Home construction concern Lennar Corporation (NYSE:LEN) is up 1% at $51.83 this afternoon, continuing its long-term climb on the charts. Traders are gearing up for the company's second-quarter report, slated for before the market opens tomorrow, June 25. Down below we will take a look as to how Lennar stock has been performing on the stock market ahead of its highly anticipated earnings.

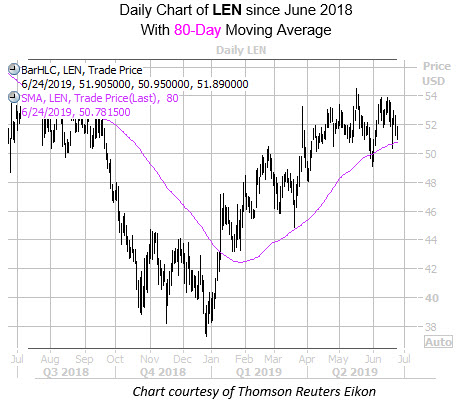

Lennar stock has been moving mostly higher since its late-December bottom of $37.29. In fact, just last month the shares touched a year-to-date peak of $54.50. A majority of pullbacks over the past year have been captured by the supportive 80-day moving average, guiding the equity to its current year-to-date lead of 31.1%.

Moving onto Lennar's earnings history, the stock has closed higher the day after earnings in seven of the past eight quarters -- including a 10% surge April 2018. Over the past two years, the shares have swung an average of 4.7% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 6.6% swing for Tuesday's trading.

Looking at options, near-term options traders are unusually call-skewed on Lennar, according to its Schaeffer's put/call open interest ratio (SOIR) of 0.35. This reading ranks in the 8th annual percentile, showing that call open interest outweighs put open interest among contracts expiring within three months by a wider-than-usual margin.

This is echoed at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows LEN with a 10-day call/put volume ratio of 10.59, ranking in the highest percentile of its annual range. In other words, calls have been bought over puts at a much quicker-than-usual pace.