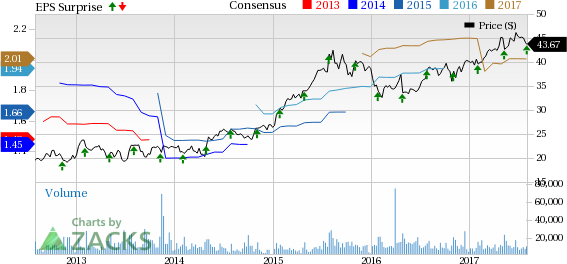

Hologic Inc. (NASDAQ:HOLX) reported third-quarter fiscal 2017 adjusted earnings per share (EPS) of 50 cents, down 1.9% year over year. However, adjusted EPS beat the Zacks Consensus Estimate by a penny and remained at the upper-end of the company’s guidance of 48–50 cents.

Strong top-line growth led to better-than-expected EPS increase in the reported quarter.

On a reported basis, the company recorded net income of $59.5 million or 21 cents per share, both reflecting a year-over-year decline of 29.8% and 32.3%, respectively.

Revenues in Detail

Revenues grossed $806.1 million in the quarter, up 12.4% year over year. The top line also exceeded the Zacks Consensus Estimate of $799 million and the company’s own estimation of $790–$805 million. At constant exchange rate (CER), revenue growth was 13.1%.

Solid growth at Hologic’s molecular diagnostics and GYN Surgical business segments drove this upside in the top line.

Geographically, revenues in the U.S. grew 9.5% year over year to $618.5 million. Excluding blood screening and medical aesthetics, the U.S. revenue rose 1.3%. On the other hand, international revenues were up 23% (up 26.5% at CER) to $187.6 million, banking on increased revenues of Breast Health and GYN Surgical products. Excluding blood screening and medical aesthetics, international revenues increased 6.8% or 10.5% at constant currency.

Segments in Detail

Revenues at the Diagnostics segment (35.2% of total revenue) declined 8.3% year over year (down 7.4% at CER) to $284.1 million in the second quarter. Under this segment, molecular diagnostics revenues of $144.1 million increased 9.3% (10.3% at CER). In the U.S., this was primarily driven by an increasing market share and utilization of fully automated Panther system, plus market expansion by conforming to testing guidelines. Internationally, results were strong from acquiring benefits of new leadership, healthy Panther placements and multiple new-product introductions, including viral load assays.

Cytology and perinatal revenues of $121 million also showed a decline of 1% (up 0.2% at CER).

Revenues at the Breast Health segment (35.1%) inched up 0.4% (up 0.9% at CER) to $283.7 million. Revenues in the U.S. declined 1.7% on reducing incremental placements of 3D gantries. International revenues however climbed 13% year over year.

Revenues from the GYN Surgical business (13.2%) were up 4.4% (up 5.2% at CER) to $106.5 million. Medical Aesthetic business in the quarter reported revenues of $110 million, 13.6% of total revenue. Revenues at Skeletal Health (accounting for the rest) dropped 5.3% (down 5% at CER) to $21.8 million.

Operational Update

In the fiscal third quarter, Hologic’s gross margin contracted 400 basis points (bps) to 50.8%. Adjusted gross margin also decreased 260 bps to 63.1% due to product and geographic revenues mix, divestiture of blood screening business and a full quarter of revenues from low-margin Cynosure products.

Hologic’s adjusted operating expenses amounted to $276 million, up 19.9% year over year. Adjusted operating margin contracted a massive 480 bps to 29%.

Financial Update

Hologic exited the fiscal third quarter with cash and cash equivalents of $588.4 million, considerably below $1.13 billion reported at the end of the second quarter. Total long-term debt was $3.22 billion at the end of the fiscal third quarter compared with $3.28 billion at the end of the preceding quarter.

Year-to-date operating cash outflow was $158.3 million compared with cash inflow of $569.7 million in the same period last year.

Fiscal 2017 Guidance

Hologic reduced its revenue guidance for fiscal 2017. The company currently expects revenues in the range of $3.04–$3.05 billion from the earlier band of $3.05–$3.08 billion. This new outlook reflects annualized growth of 7.3–7.8% (previously it was 7.7–8.7%). The current Zacks Consensus Estimate of $3.07 billion remains above the company-provided guidance.

Management has however raised the lower end of the earlier provided adjusted EPS outlook for fiscal 2017. Hologic currently projects adjusted EPS in the range of $2.00–$2.02 (from previous $1.98–$2.02) for fiscal 2017, reflecting annualized growth of 2–3.1% (1–3.1%). The current Zacks Consensus Estimate for adjusted EPS is pegged at $2.01, falling just below the upper end of the guided range.

For fourth-quarter fiscal 2017, Hologic expects revenues of $785–$800 million, representing annualized growth of 8–10.1%. The current Zacks Consensus Estimate for fourth-quarter revenues is $798.9 million, close to the upper end of the projected range.

Adjusted EPS is projected at 48–50 cents, an annualized decline of 7.2–3.4%. The current Zacks Consensus Estimate for fourth-quarter adjusted EPS is pegged at 49 cents, within the company’s guidance.

Our Take

Hologic posted better-than-expected third-quarter fiscal 2017 results in terms of both earnings and revenues. The company’s strong cash position is another encouraging factor.

However, we are disappointed with the decrease of revenues at the company’s Diagnostics segment. The blood screening divestiture is expected to mar the company’s growth momentum in the days ahead. Overall, the company’s reduced revenue guidance for fiscal 2017 lowers investors’ confidence in the stock.

Zacks Rank & Other Key Picks

Hologic currently has a Zacks Rank #4 (Sell).

Some of the medical stocks worth considering are Edwards Lifesciences Corporation (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has expected long-term earnings growth rate of 20%. The stock has gained around 4.7% over the last three months.

Align Technology has expected long-term adjusted earnings growth of almost 24.1%. The stock has surged roughly 24.7% over the last three months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 4.7% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Hologic, Inc. (HOLX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research