U.S. refiner HollyFrontier Corp. (NYSE:HFC) reported strong second-quarter results, helped by improving refining margins, higher production and contribution from the newly acquired PCLI unit.

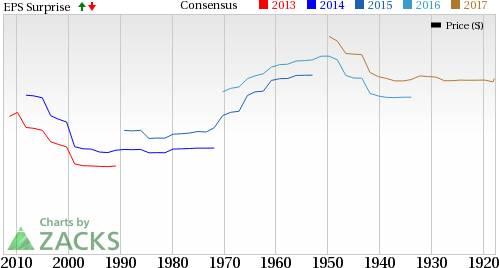

The company’s net income per share (excluding special items) came in at 66 cents, handily beating the Zacks Consensus Estimate of 46 cents and significantly ahead of the year-ago period profit of 28 cents.

Revenues of $3,458.9 million surpassed the Zacks Consensus Estimate of $3,386 million and climbed 27.4% from the second-quarter 2016 sales of $2,714.6 million.

Segmental Information

Refining: Net income from the Refining segment – which is the main contributor to HollyFrontier earnings – was $86.6 million, turning around from the loss of $436.2 million in the year-ago quarter. The improvement reflects wider gross margins, which jumped 29% to $11.47 per barrel.

Total refined product sales volumes averaged 483,210 barrels per day (bpd), up 9% from the 442,660 bpd in the year-ago quarter. Moreover, throughput increased from 428,590 bpd in the year-ago quarter to 467,090 bpd. Capacity utilization, at 102.13%, was up from 101.7% in the second quarter of 2016.

PCLI: Income from the newly acquired Petro-Canada Lubricants Inc. (or PCLI) business – bought from Canadian oil and gas giant Suncor Energy Inc. (NYSE:SU) earlier this year – totaled $12.6 million. Product sales averaged 23,720 bpd, while production and throughput came in at 20,880 bpd and 21,470 bpd, respectively.

HEP: This unit includes HollyFrontier’s 36% interest in Holly Energy Partners L.P. (NYSE:HEP) , a publicly-traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets.

Segment profitability was $43.3 million, up from $39.9 million in the second quarter of 2016. Earnings were buoyed by higher volumes.

Balance Sheet

As of Jun 30, 2017, HollyFrontier had approximately $460.3 million in cash and cash equivalents and $2,228.0 million in net long-term debt, representing a debt-to-capitalization ratio of 29.8%.

Share Performance

Shares of HollyFrontier have lost 6.8% year to date, compared to the industry's 4.4% decline.

Zacks Rank & Stock Picks

HollyFrontier holds a Zacks Rank #3 (Hold).

Meanwhile, investors wanting exposure to the oil refining space may opt for and Par Pacific Holdings Inc. (NYSE:PARR) – a Zacks Rank #2 (Buy) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Par Pacific Holdings, Inc., based in Houston, TX, is a diversified energy player that operates in 4 segments: Refining and Distribution, Retail, Commodity Marketing and Logistics, and Natural Gas and Oil. Over the past 30 days, the company has seen the Zacks Consensus Estimate for 2017 increase 76% to 79 cents per share.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

HollyFrontier Corporation (HFC): Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR): Free Stock Analysis Report

Suncor Energy Inc. (SU): Free Stock Analysis Report

Holly Energy Partners, L.P. (HEP): Free Stock Analysis Report

Original post

Zacks Investment Research