Predictably quiet G-10 session with the US market closed for Thanksgiving, but EM currencies dominated price action.

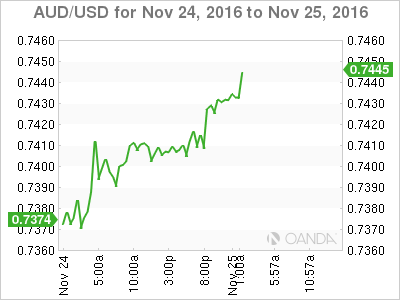

Australian Dollar

The Aussie dollar has held up remarkably well against broader USD strength and while the high betas, in general, came under stress the Aussie performed remarkably well holding it’s own versus EUR and JPY. Commodity prices and oil supply cut headlines are providing essential support for the commodity bloc.

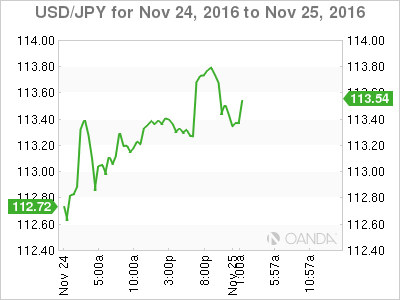

Japanese Yen

USD/JPY continues to ratchet higher primarily driven by higher US bond yields and supportive US economic data. Apparently, the USD/JPY continues to be the most favourable currency pair to express a US dollar strengthening bias. Price action suggests markets still under positioned dollar as any sell-offs are shallow and running into a wall of buyers. UST 10’s touched a high of 2.416 % spurred on by strong USD durable goods and solid consumer sentiment gauges.

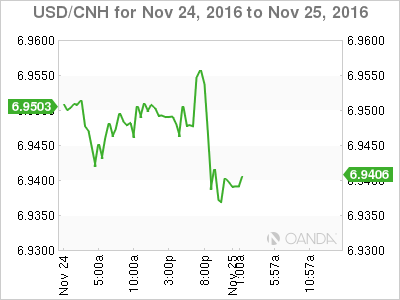

Chinese Yuan

The lack of intervention has traders probing higher as the supportive US economic data provided a significant tailwind for the stronger USD move.

Emerging Markets (EM)

The Turkish Central surprised the market and decided to hike the benchmark rate by 50bps to 8% for the first time since 2014. It also increased the OLR to 8.50% by 25bps, with the OBR left unchanged at 7.25%. The consensus forecast was for no rate change across the board. Regardless the lira fell aggressively as the rate hike did little to alter the markets worsening expectations, nor modify the market's prevailing view for a weaker TRY.

![]()

EM ASIA

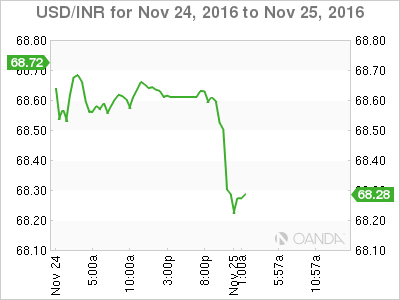

USD/INR traded to a high of 68.75 feeling the fallout from the demonetization policy. Global investors are concerned that this move will weigh negatively on economic growth outlook.