Doing things right

IMS confirmation of H2 resilience is welcome as conditions remain testing. Stable constant currency revenue in the four months to January suggests an improving trend and reinforces confidence that Hogg Robinson Group Plc, (HRG) is on course to meet current year expectations. Despite further share price outperformance, the rating is low, while the dividend has good cover (3.5x FY14 pre-exceptionals). The slight reduction in our forecasts wholly reflects currency translation impact.

Solid IMS

HRG continues to do the right things. Maintaining constant currency revenue in the four months to January was satisfactory, given subdued markets in Continental Europe and Asia and the trend to online self-booking by clients. It compares favourably with -3% in Q2 and -7% in FY13. Cost control remains well in hand both in terms of adjustment to demand, where management has proved very effective, and reorganisation, which is targeting annualised savings of £6.5m. Reported “strong” cash generation since September underpins our forecast of a £7m cut in net debt to £80m at March 2014.

Forecasts unchanged but for currency translation

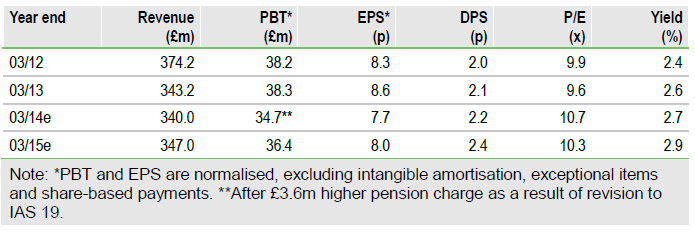

Our forecasts for FY14 and FY15 have been cut slightly (eg c 3% effect on EPS) owing to the strengthening of sterling, principally against the euro and the US dollar. Otherwise we remain confident about the robustness of the company’s fee-based model and the opportunity for margin gain, thanks largely to cost control (including initial benefits from the aforementioned actions), new technology sales and online self-booking. Macro indicators are encouraging with continued optimism in global lodging (Starwood today confirmed +5-7% worldwide RevPAR guidance for 2014) and air travel (up 5% in 2013, per IATA, with a “broadly positive” outlook).

Valuation: Attractive

Notwithstanding further outperformance (c 7% against FTSE All-Share since November’s interims), HRG’s FY15e P/E rating remains low (10x) compared with that of the All-Share support services sector (c 17x). The company is well financed, cash generative and has a progressive dividend policy with a well-covered yield.

To Read the Entire Report Please Click on the pdf File Below