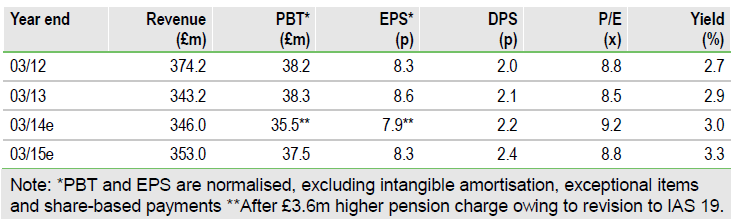

IMS confirmation of a decent Q1 may preface returns ahead of expectations, given the tendency of Hogg Robinson’s (HRG) operational gearing to surprise, while cash generation (also confirmed by the IMS as “strong”) should allow further dividend growth. Broadly positive company and macro indicators have led to share price outperformance, though still modestly rated, and justify continued investor confidence. We are introducing FY15 forecasts, which highlight the resilience of corporate travel service earnings.

Reassuring IMS

HRG is on course to meet current year expectations. Indeed, a pickup in constant currency revenue in Q1 (+1% against -7% in H213) and guidance of “good progress” over the full year appear amply to support our FY14 forecast of maintained constant currency trading profit. However, these are early days (profit is second-half oriented) and tough times advise caution, while H113 was flattered by one-off benefits of a licensing agreement with a leading GDS provider (not quantified, but we assume to be the bulk of new technology sales that contributed £2m trading profit in the period). Reported “strong” cash generation in Q1 underpins our forecast of a £7m cut in net debt to £80m at March 2014. Further action has been taken, as expected, to tackle the company’s pension deficit.

More of the same in FY15

We expect margin gain to continue to mitigate pressures on revenue thanks to effective cost control, increased online booking, sharing of client cost savings and greater exposure to higher-margin technology and travel-related services. There should be particular benefit from current action (c £6.5m exceptional charge to be incurred this year) to reduce costs (locations, back-office functions etc). The opportunity to expand relationships with existing clients is shown by today’s significant award of the EMEIA travel contract for EY, effective from September. We look for trading margin to rise from 14.4% to 14.6% on 2% higher constant currency revenue, which may be pessimistic given HRG’s record of margin delivery.

Valuation: Appealing

Despite recent outperformance (c 30% against FTSE All-Share over the past three months), HRG’s FY14e P/E rating remains low (9x) compared with that of the All-Share Support services sector (c 16x). The company is well financed, cash generative and has a generous dividend policy (the yield has strong cover of 3.6x).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hogg Robinson

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.