Data storage name Seagate Technology PLC (NASDAQ:STX) is up 0.3% at $45.11 in today's trading, moving higher as investors anticipate the company's upcoming quarterly report. STX's fiscal third-quarter results are scheduled for before the market opens tomorrow, April 30. Below, we will dive into what the options market is anticipating in terms of a post-earnings move, as well as why Seagate stock may be in store for its next leg higher.

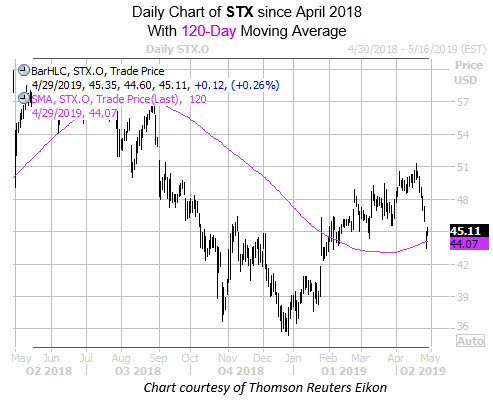

On the charts, the tech giant has seen overall improvement from its late-December lows, last seen up 16% year-to-date. And despite last week's bear gap and pullback to the $45 level, the shares have stabilized above the historically supportive 120-day moving average.

Specifically, the security has moved within one standard deviation of its 120-day moving average after a lengthy stretch above it, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Over the past three years, there have been four other times this signal has sounded, resulting in an average one-month gain of 6.37% for STX stock, with a 75% success rate.

Moving onto STX's earnings history, although the tech name has closed lower the day after reporting in five of its past eight reports, as recently as early November, the stock saw a post-earnings surge of 3%. Over the past two years, the shares have swung an average of 7.2% the day after earnings, regardless of direction. This time around, the options market is pricing in a higher-than-usual 12.4% swing for Tuesday's trading.

Lastly, short interest on the equity fell 18.7% during the past two reporting periods and now accounts for nearly 6.1% of the stock's total available float. At STX's average pace of daily trading, it would take shorts nearly six days to buy back their bearish bets.