Investing.com’s stocks of the week

Historical Precedent

A common bearish argument making the rounds over the past year goes something like this:

Stocks have been rising for over eight years; they can't keep going up.

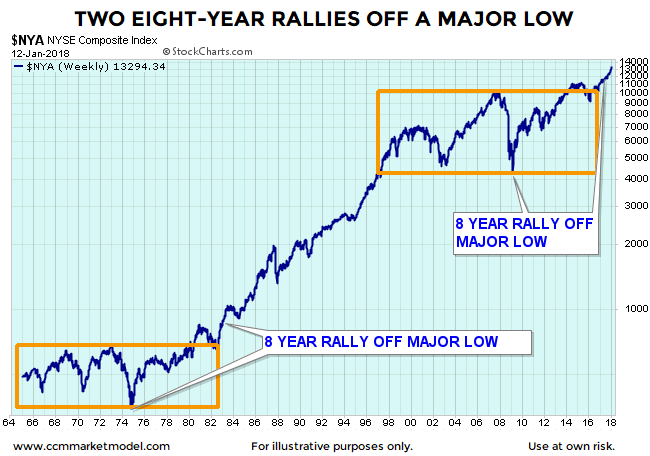

As shown in the NYSE Composite chart below, stocks rallied for eight years off a major low in 1974, broke out to a new all-time high, and then subsequently rallied for an additional 18 years. In present day, stocks rallied off the 2009 major low and broke out in 2017 making a new all-time high.

What Happened Next?

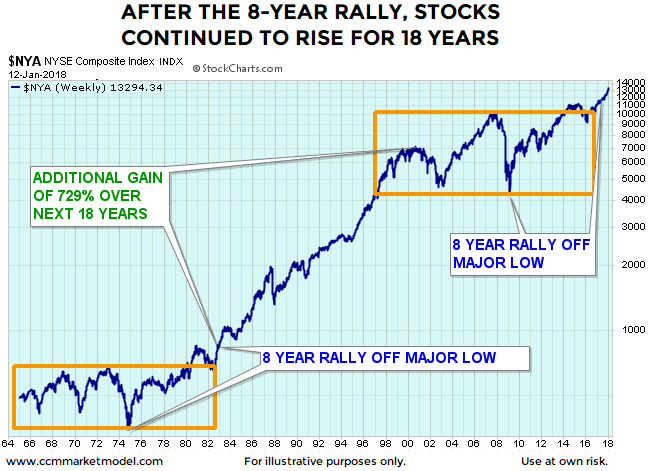

Given humans tend to extrapolate the recent past into the future, many expect the next major move for the markets in 2018 is a 50%-plus bear market similar to the 2000-2002 and 2007-2009 periods. That is not what happened after the similar historical setup in the early 1980s. Instead of following the 1964-1980 script, stocks tacked on an additional gain of over 700% (see chart below).

But What About Valuations?

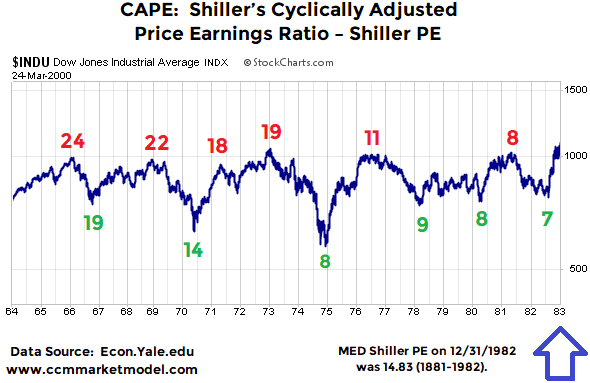

If we are to take the "all the charts are meaningless because of valuations" argument seriously, we must convince ourselves that valuations were a useful timing tool between 1964 and the stock market peak in 2000.

A Fair And Fact-Based Assessment

In order to make a prudent assessment of the real-world utility of valuations, we must review the information that was available as stocks marched higher between the end of 1982 and 2000. For example, when stocks broke out to a new all-time high in 1982, the median Shiller PE or CAPE ratio looking backwards (1881-1982) was 14.83.

This week's video takes a detailed look at two periods, 1992-2000 and 1956-2000, to evaluate the effectiveness of attempting to use the Shiller PE or CAPE ratio as a market timing tool. In the video, Shiller PEs are reviewed on stock charts, allowing you to draw your own fact-based conclusions.

Long-Term Means Long-Term

Just as there was normal and sometimes gut-wrenching volatility between 1983 and 2000, even if better than expected outcomes occur over the next 3-20 years, volatility will be part of the equation.