History doesn't repeat itself but it often rhymes.

– Samuel Clemens (Mark Twain)I decided that before I sat down to write the weekly recap and outlook for the gold and silver markets that I would go to a few of the great commentary sites such as Streetwise, 321Gold, Goldseek and Gold-Eagle and read what the other "experts" are saying about the precious metals markets before I attack the keyboard. Earlier in the week, I had been working on a Western Uranium Corp. story and was astounded how stress-free it was writing about an energy deal as opposed to a sound money deal. After perusing perhaps two hundred paragraphs from some pretty smart guys and gals, it occurred to me that we are all looking at the same data and the same charts and reading the same headlines in an effort to sound original in our assessment of the metals

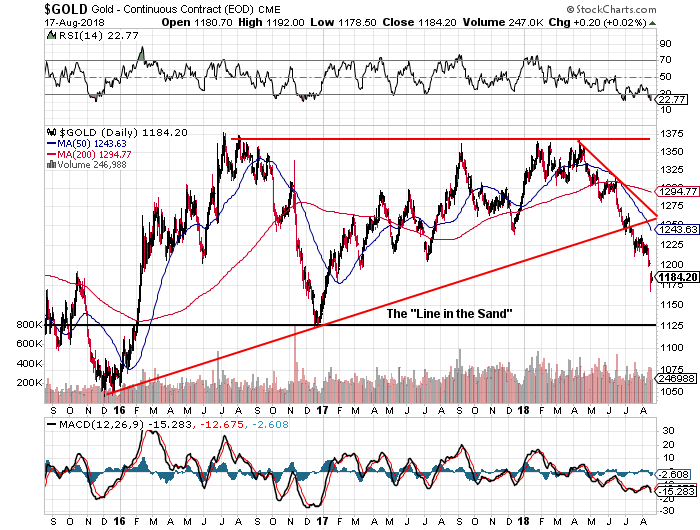

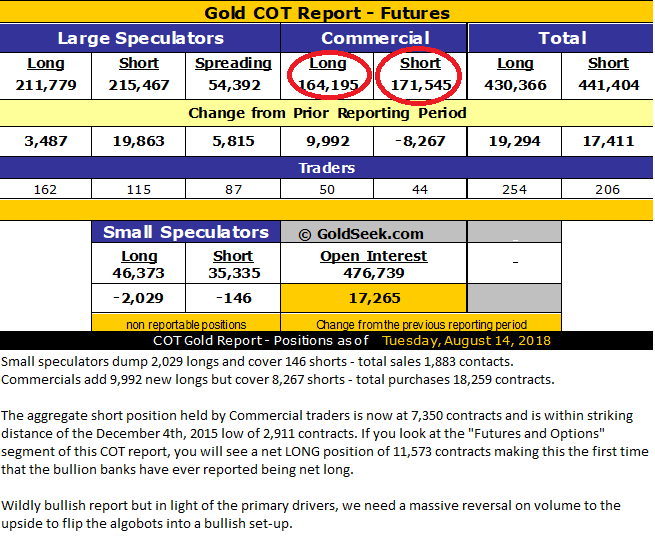

But what we are all missing are two very important and, in fact, crucial realities of today's markets and I am going to focus on these in today's missive. I could write about the COT report due out any moment (which I predict will be a doozy, with the Commercials recording a net long position for the first time ever), or I could drone on and on about RSI and MACD and the histograms and inverted teacups and screaming Dojis and hallucinating haramis, but it is all meaningless drivel in the context of the primary drivers for gold and silver. All that matters is that since the 2016 top at around $1,365 per ounce, gold has been unable to sustain any upward momentum thanks largely to the drivers.

Driver #1: Computerized Trading And Algobots

In 1998, I was first introduced to the concept of pattern-recognition algorithms that could trade stocks based upon the software's uncanny ability to scan predictive movements and formations and execute buy or sell programs on such interpretation. The growth of computer-driven money management has now resulted in trading "floors" nearly devoid of human interaction, with carbon units only present to make sure the machines don't go berserk (which they have on multiple occasions).

In vast, highly liquid markets like Forex and bonds and stocks, these algobots can operate fairly effectively, but in thin markets like commodities (and especially gold and silver), the algobots have a habit of feeding off each other. Once a short-term trend has been established, the 'bots pounce and, in fact, extend and exaggerate it to the point of insanity. Once the 'bots get control of the near-term trend, all other life forms join the party and the meme-du-jour becomes status quo, and there is no economic, financial or geopolitical event that will reverse it. The 'bots do not analyze; they simply react and execute.

For this reason, I refute the idea that the Chinese are rigging the gold market by pegging the yuan to gold via the USD/CNY exchange rate. For most of the 2014-2018 period, a number of the blogger-gurus chortled on about how gold mirrored the JYP/USD cross—and before that the USD/EUR cross—but all that was, IMHO, was the pattern-recognition software picking up a working correlation and reacting to it. The more it worked, the more the 'bots did it, and the cycle repeats itself over and over and over until the algo-scanners detect a "new kid on the block" of correlation. At that point, they run with it.

And because it is so completely warped in its extent and its intensity, the carbon-based trading units get on the keyboards and post accusatory rants about some sovereign entity rigging the price with all the fancy gold-yuan overlay charts being irrefutable "proof." All it really proves is that the 'bots have detected a correlation trend, and they have hijacked it. If any trading platform can abuse the system with not even the slightest of regulatory repercussion, it is the computers.

So, driver #1 is the existence of the algobots, and while it is entirely possible they are the riggers of the precious metals markets, they do so not from anything sinister or policy-driven; they are simply following the code written for them by the programmers.

Driver #2: Central Banks And Currency Regimes

Lord Rothschild said, "Give me control of a nation's money and I care not who makes its laws." And nowhere is that more evident than in the attitude of the banking community toward sound money. Bankers make fees from currency, and the more currency they control, the more fee income they derive.

For this reason, currency debasement is the primary incentive of all bankers. Take the financial crisis of 2007-2008. The global economy was humming along just fine, with the exception of the U.S. mortgage and housing market, where lack of adequate regulation allowed the markets to get out way ahead of their skis, resulting in a crash.

However, the only people affected were the banks and, technically, they were all toast. But since that would have vaporized shareholder equity for the elite class (primarily the bankers), it would have been a relative non-event for the rest of the working and middle class.

Now, this is a point of fierce debate because it is said that everyone was going to be impacted because "the system was freezing up," which included deposits, but the vast number of Americans whose balances were well below the federal deposit insurance guarantee ($100,000 in Canada) were not at risk. Only the owners of the banking shares were at any real risk, so rather than allow the natural elimination of those entities that took unnecessary risks and failed, Hank Paulson begged Congress for, and received, a massive bailout through printed, fabricated, phony counterfeit money. In this manner, the utility of gold and silver as the rightful providers of safe-haven attributes was snatched away and replaced with the utmost of moral hazard.

Ten years later, with stock valuations stretched on the crest of a $14 trillion injection wave, gold and silver have been relegated to the role of cult-status investing. Only old people in North America (and citizens of Argentina, Venezuela and Turkey) believe in the safe-haven utility of gold and silver. Further, the youngsters would rather own pot stocks and cryptodeals (or Elon Musk's Rocket to Mars for the price of a pizza deal) rather than two metals representing 5,000 years of monetary functionality.

In a nutshell, central banks and politicians know that if gold succeeds as a replacement for the rotting paper currency that underpins the "system," then the Emperor's-New-Clothes-Ponzi-scheme gig will be up and they will be unable to sustain this tax-and-spend, boom-and-bust cycle that allows the banker/politician criminal partnership to flourish.

The investing pubic also knows that gold is the mortal enemy of the money-printers/credit-creators because it shines an embarrassing and incriminating light on the banking cartel and their Machiavellian maneuvers. It is for this reason that they opt for Bitcoin as a receptacle for excess currency units and an alternative to bank accounts that can be subject to bail-ins and other confiscatory procedures.

These are the two primary drivers that dominate the demand-supply conundrum that infuriates fundamental analysts in their assessment of the balance of money flow between the buyer and seller of gold and silver. Their influence has dwarfed all forms of fundamental and technical analysis, and has completely negated their impact on pricing. It has been further exacerbated by driving participants away from the market because of the constantly inexplicable behavior whereby price defies historical directional stimuli and moves as if guided by some "invisible hand." This type of behavior is always, and without fail, the result of interventions that free market advocates abhor.

The COT Report

Just as I complete a thorough debunking of "all that has worked in the past," and having declared it obsolete, out comes the COT report. It is a wildly bullish report from a couple of perspectives. First, the Commercial aggregate short position is now within 5,000 contracts of the December 2015 bottom in gold at $1,045. Second, the net shorts for Large Specs (dumb money) at 215,500 contracts is 45% higher than it was at the bottom in December 2015. In a normal world, absent the criminal interventions and manipulations mentioned earlier, I would go "all in" on options on the JNUG and NUGT, and buy several hundred GLD (NYSE:GLD) contracts for January expiry. However, I am awaiting evidence of a short squeeze, engineered and triggered by the Commercials and agonizingly executed by the Large Specs, who stand to get annihilated if gold turns now.

I would also observe that in referring back to primary Driver #1, there is no rational human being, analyst or otherwise, who would allow a position in anything to grow as large as what we have witnessed in the Large Spec aggregate short position. Prudent portfolio management would prune down, but since the algobots are only reactive (to trends), they have simply followed the programming code and piled on. When the programming rules instruct them to cover, there will be a mad scramble to do so, and that is what will send this pendulum of doom in the opposite and welcomed direction.

Once I see evidence of distressed buying (hopefully this week), I will be adding to the GLD options, where a month ago I took a 25% opening position in the October $120s (some $5 higher). The beauty of scaling into positions over a number of days (or weeks) is that you can be wrong in your timing but still live to fight another day. I still have 75% of the original funds available to add to positions, but at levels far more palatable than they were thirty days ago. In this manner, I am able to avoid taking a sledgehammer to my forehead in self-recrimination and loathing.

As the title of this missive implies, conditions for the gold and silver markets are today similar, but not identical, to conditions in 2015, when prices bottomed and set up one of the most breathtaking rallies of my career, which lasted until August of 2016. The HUI followed later, on January 19, 2016, with a bottom tick of 99.17 before screaming to over 280.

Yes, it is true that history never repeats, but as for rhyming, this is a "Casey-at-the-Bat" poem in full regalia. Everything about the bottom of December 2015 is now in place, with even greater force and conviction. We shall soon see whether a historical repetition of the events of 2015-2016 unfold, unleashing a cavalcade of stampeding buyers in gold and silver bullion, futures, junior and senior gold miners and, of course, the explorers.

Bring it.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Historical Repetition In The Precious-Metals Arena

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.