The Hindenburg Omen, a 'technical indicator based on Fosback's High Low Logic Index (HLLI), is flashing a warning signal again. The HLLI, a combination of technical factors that attempt to measure the health of the NYSE and stock market as a whole, is the lesser of the NYSE new highs or new lows divided by the number of NYSE issues traded. The HLLI defines balance within the market. A substantial number of stocks may set either new annual highs or new annual lows, but not both at the same time under normal market conditions. In other words, a healthy market possesses a degree of uniformity. Observation of simultaneous new highs and lows suggests growing imbalance and trouble. Trouble with the HLLI, something I have witnessed first hand, is that imbalance produces a lot of false signals. That is, a lot of Omens that do not materialize into crashes.

Whether it be the Hindenburg Omen, overvaluation of fundamentals, or some other technical evidence, the bears, seizing weakness during cause building, are embracing anything that supports their opinion.

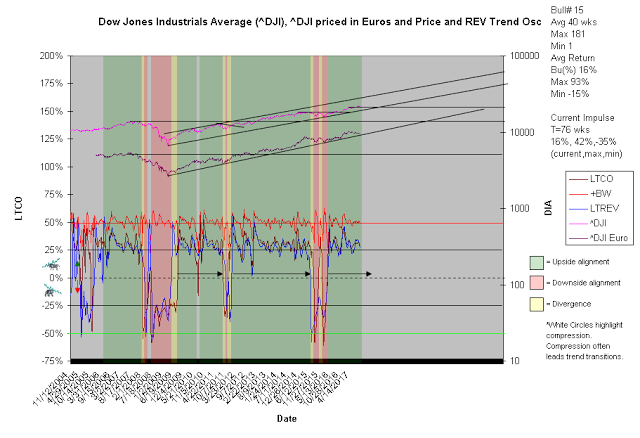

The message of the market for US stock since 1999 is as follows (chart1):

1. 15 weekly aligned up impulses.

2. Time (avg, max, min): 40 wks, 181, 1.

3. Average annualized return profile (impulse, max, min): 16%, 93%, -15 %.

4. Current impulse: 76 wks, 15%, 42%, -35% (current, max, min).

Trading Notes tracks these trends in detail.

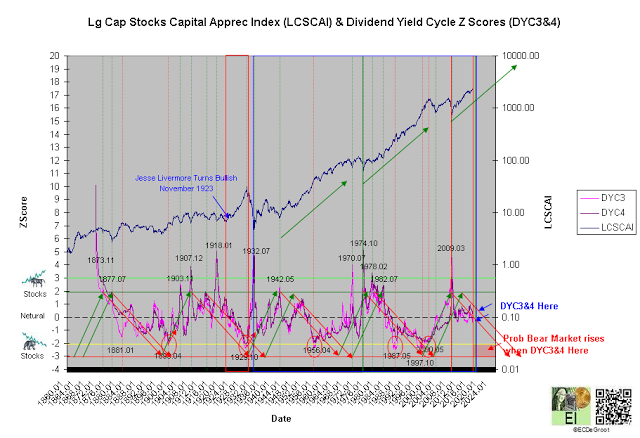

Is the market overvalued? Highly concentrated and ready to crash? Dividend cycle concentrations say no (chart2). Dividend Yield Cycles provide further discussion of this topic.

Headline: Bad news for the stock market: The Hindenburg Omen is back

The dreaded Hindenburg Omen is back.Named for the German airship that met its demise in a fiery explosion 80 years ago, the appearance of this technical pattern sometimes portends a stock-market crash.