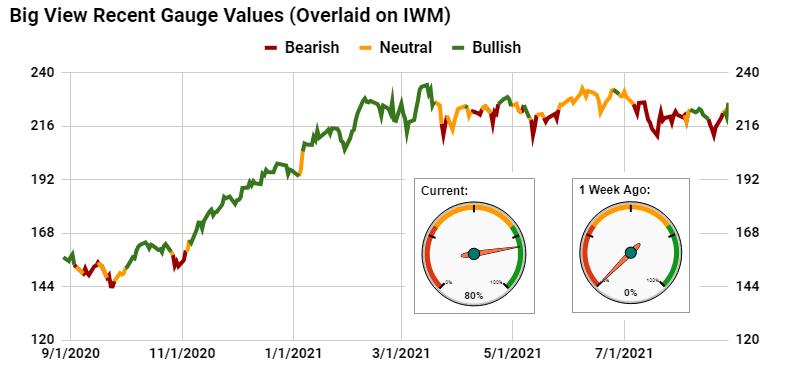

This past week's markets regained their footing with risk gauges improving while the Hindenburg Indicator increased its reading to ominous levels as well. Market internals improved across key equity benchmarks to best levels since mid-June, benefitting small caps (IWM/Grandpa Russell) the most, up over 5% for the week while bumping both 3 and 6 month returns to positive territory.

Along that vein, gold also bounced and significantly improved its technical picture getting a tailwind from increased geopolitical stress, a dovish fed, and a weaker dollar. The takeaway is that the buy and hold crowd is most at vulnerable and (our) risk management is even more critical as we head into September.

The week’s market highlights

- Risk Gauges improved from Risk off last week with IWM leading to risk on

- IWM has rallied roughly 7.5% off the lows since the prior week, which bounced from oversold conditions, clearing both the 50 and 100-DMA

- The SPDR® S&P 500 (NYSE:SPY) and the Invesco QQQ Trust (NASDAQ:QQQ) hit all-time highs and were not overbought based on our Real Motion indicators

- Market internals improved significantly from oversold levels and looked the best since mid-June

- Market Volatility (VIX) moved back into a bearish phase confirming the risk on scenario

- On a cautionary note, the Hindenburg Omen indicator was showing an increased number so vigilance is key as risk on condition can reverse quickly

- Volume patterns improved modestly

- Soft Commodities—Invesco DB Agriculture Fund (NYSE:DBA), Copper—United States Copper Index Fund, LP (NYSE:CPER), and Gold (NYSE:GLD) rallied strongly on Jerome Powell’s dovish talks on rates.

- Oil (NYSE:USO) bounced nicely, but still needs to take out the 6-month calendar range low and the 50-DMA.

- Gold had a very strong move on Friday clearing its 200 and 50-DMA in one shot and getting tailwind from geopolitical stress and low rates at the same time

- Long Bonds—iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) had price creating a channel/wedge formation in recent weeks, looking for a potentially significant breakout if the price closes over the $151 level

- Growth—Vanguard Growth Index Fund ETF Shares (NYSE:VUG) maintained its leadership over Value—Vanguard Value Index Fund ETF Shares (NYSE:VTV) adding to the risk on market scenario

- All members of the Economic Modern Family reversed last week's readings led by semiconductors—VanEck Vectors Semiconductor ETF (NASDAQ:SMH) to all-time highs, therefore confirming the risk on environment.

- Emerging Markets—iShares MSCI Emerging Markets ETF (NYSE:EEM) bounced over oversold conditions highlighted from last week.

Crypto Corner

By Holden Milstein

Bitcoin (BTC) started last week with price getting over the $50,000 level on Monday before drawing back down to a weekly low at $46,300 later in the week and finding strong support at the 200-DMA. A Sunday close over $49,300 would have given Bitcoin a positive weekly close for the 6th week in a row, as well as place BTC's price back within the 2-month range that led to an over $64,000 all-time high earlier in 2021.

Ethereum (ETH) remained relatively flat last week while competing decentralized-finance projects Cardano (ADA) and Solana (SOL) both reached new all-time highs (both of which are top 10 coins by market cap).

NFTs (Non-Fungible Tokens) saw astronomical sales prices, as many within the cryptocurrency community were using these virtual items as new forms for storing value, similarly, to investing in a piece of art or a highly collectible piece of sports memorabilia. This diversification of investment types within the crypto space is indicative of the accelerating rate of adoption to the emerging technologies built on blockchain.