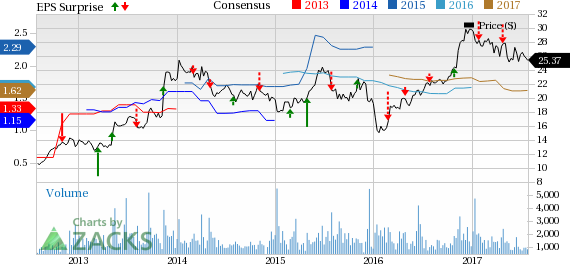

Hilltop Holdings Inc. (NYSE:HTH) reported second-quarter 2017 earnings per share of 63 cents, which easily surpassed the Zacks Consensus Estimate of 43 cents. The figure was 96.9% above the prior-year quarter’s earnings of 36 cents. Results in the reported quarter include certain non-recurring items.

Higher interest income, a slight fall in expenses and significantly lower provisions support the results. Also, improvement in loans and deposits acted as a tailwind. However, fall in non-interest income was an undermining factor.

Net income applicable to common stockholders came in at $62.5 million, increasing 101.1% year over year.

Revenues Rise, Costs Dip

Operating revenues for the quarter were $460.7 million, up 3.2% year over year. The figure also beat the Zacks Consensus Estimate of $431.8 million.

Net interest income for the quarter grew 15.5% year over year to $116 million. Net interest margin was 4.04%, up 27 basis points (bps) from the prior-year quarter.

Non-interest income dropped marginally from the year-ago quarter to $344.7 million. The figure included certain non-recurring items. The decline was mainly due to lower income from sale of loans and other mortgage production income, investment and securities advisory fees and commission income along with low insurance premium earned.

Non-interest expenses declined slightly year over year to $366.3 million. This was largely attributable to lower loss and loss adjustment expenses, employees' compensation and benefits expenses, and other expenses.

Credit Quality: A Mixed Bag

Provision for loan losses was $5.9 million, down 79.7% year over year.

However, non-covered non-performing assets as a percentage of total assets were 0.26%, up 6 bps from the prior-year quarter. Also, non-covered non-performing loans were $29.5 million, up 26.3% year over year.

Strong Balance Sheet

As of Jun 30, 2017, Hilltop Holdings’ cash and due from banks was $405.9 million, down 25.6% sequentially. Further, total shareholders’ equity was $1.9 billion, almost flat year over year.

Net non-covered loans were $6.1 billion as of Jun 30, 2017, up 5.8% sequentially. Also, total deposits grew 3.3% from the prior-quarter to $7.6 billion.

Profitability & Capital Ratios Improve

Return on average assets as of Jun 30, 2017 was 1.94%, up from 1.05% in the prior-year quarter. Additionally, return on average equity was 13.24%, up from 7.07% in the year-ago quarter.

Common equity tier 1 capital was 17.53%, up from 16.67% as of Jun 30, 2016. Also, total capital ratio was 18.57%, increasing from 17.69% in the prior-year quarter.

Our Take

Hilltop Holdings solid organic growth strategy is expected to enhance its long-term growth. Further, improving loan and deposit balances will lead to top-line growth. Also, the company’s capital deployment plans remain impressive.

Hilltop Holdings currently carries a Zacks Rank #2 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Associated Banc-Corp (NYSE:ASB) reported second-quarter 2017 earnings per share of 36 cents, in line with the Zacks Consensus Estimate. Results benefited primarily from an improvement in revenues and lower provision for credit losses, which were offset by higher expenses.

Commerce Bancshares, Inc.’s (NASDAQ:CBSH) second-quarter 2017 earnings of 75 cents per share easily surpassed the Zacks Consensus Estimate of 70 cents. Results were mainly driven by higher net interest income and non-interest income. However, a rise in expenses and provision for loan losses were the undermining factors.

First Republic Bank’s (NYSE:FRC) second-quarter 2017 earnings per share came in at $1.06, missing the Zacks Consensus Estimate of $1.09. Higher revenues during the quarter were primarily responsible for the bottom-line improvement. On the other hand, higher expenses and provisions remained a headwind.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Commerce Bancshares, Inc. (CBSH): Free Stock Analysis Report

Associated Banc-Corp (ASB): Free Stock Analysis Report

FIRST REPUBLIC BANK (FRC): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

Original post

Zacks Investment Research