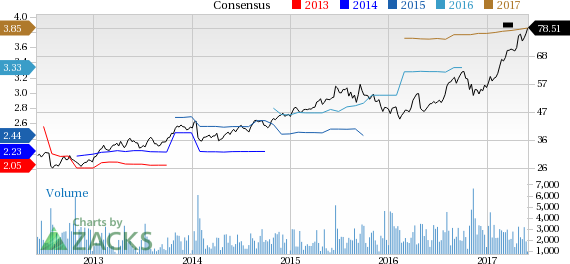

Share price of Batesville, IN-based Hill-Rom Holdings, Inc. (NYSE:HRC) scaled a new 52-week high of $78.51 on Jun 1. The company has gained 56.8%, much better than the S&P 500’s gain of 15.9% and Zacks categorized Medical - Products industry’s gain of 10.8% over the last one year. The stock has a market cap of $5.16 billion.

This Zacks Rank #2 (Buy) company has an impressive long-term earnings growth rate of 10%, higher than industry average of 3.7%

Meanwhile, Hill-Rom’s current year estimate revision trend is promising. In the past 60 days, six estimates have gone up with no downward revision for the current quarter. The magnitude of the estimate has improved by 0.7% to $3.85 over the same period.

The company has a discounted PEG ratio of 1.67, compared to the broader industry’s 2.20. It has also recorded a Price/Sales ratio of 1.84, lower than the industry’s 3.61.

Accordingly, the company holds an impressive Value Style Score of B. Our Value Style Score highlights all the vital metrics to focus on value stocks offering high yields. Our research shows that stocks with a Value Style Score of ‘A’ or ‘B’ when combined with a Zacks Rank #1 (Strong Buy) or 2 offer the best investment opportunities in the value investing space.

Growth Catalysts

Hill-Rom continues to grow strongly on its strategy of product expansion and diversification. The company recently introduced Hill-Rom Envella Air Fluidized Therapy Bed which offers the highest quality wound care. Apart from this, the company has launched Hill-Rom 900 Accella bed system for higher acuity patients in intensive and acute care settings.

Prior to this, management had announced the introduction of Monarch Airway Clearance System which represents Hill-Rom's foray into mobile therapy. This is a major breakthrough for the company to gain space in the digital health front.

The market is also optimistic about the company’s consistent inorganic growth trajectory. The acquisition of Welch Allyn has helped the company drive innovation in the medical device space and patient care solutions. The buyout has helped Hill-Rom gain a wider global reach with operations in 30 countries. Management is currently looking to expand in international markets on successful execution of its strategy, courtesy of its efficient international team and organizational realignment.

Other Key Picks

Other top-ranked stocks in the broader medical sector are Luminex Corporation (NASDAQ:LMNX) , Inogen, Inc. (NASDAQ:INGN) and Accelerate Diagnostics, Inc. (NASDAQ:AXDX) . Notably, Luminex and Inogen sport a Zacks Rank #1, while Accelerate Diagnostics carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Luminex has an expected long-term adjusted earnings growth of almost 16.3%. The stock added roughly 12.4% over the last three months.

Inogen has a long-term expected earnings growth rate of 17.5%. The stock has a solid one-year return of roughly 82.0%.

Accelerate Diagnostics has a long-term expected earnings growth rate of 30.0%. The stock added roughly 10.1% over the last three months.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Luminex Corporation (LMNX): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Accelerate Diagnostics, Inc. (AXDX): Free Stock Analysis Report

Hill-Rom Holdings Inc (HRC): Free Stock Analysis Report

Original post

Zacks Investment Research