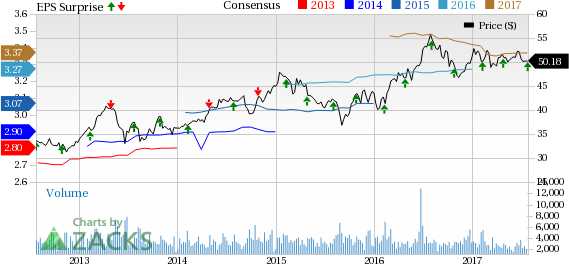

Highwoods Properties Inc. (NYSE:HIW) reported second-quarter 2017 funds from operations (FFO) of 90 cents per share, beating the Zacks Consensus Estimate by 5 cents. This also compares favorably with the year-ago number of 82 cents.

Results reflect robust growth in same-property net operating income (NOI) and strong leasing metrics.

Total revenue for the quarter increased 6.2% year over year to $177 million. The number also surpassed the Zacks Consensus Estimate of $171 million.

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

Quarter in Detail

Highwoods leased 575,000 square feet of second-generation office space during the quarter. Same property cash NOI rose 5.3% year over year.

The company announced development projects worth $99 million, which is 77% pre-leased. Also, the company put in place $208 million development in service, which is 96% leased.

As of Jun 30, 2017, Highwoods had $13.3 million of cash and cash equivalents compared with $49.5 million as of Dec 31, 2016.

2017 Outlook

Highwoods revised its 2017 FFO per share guidance range to $3.33–$3.38 from the previous range of $3.29–$3.40. The Zacks Consensus Estimate for 2017 is currently pegged at $3.37.

Our Viewpoint

Improving operating performance reflects bright prospects for the company. Highwood is making concerted efforts to expand its footprint in high-growth markets and enhance portfolio quality through strategic asset allocation and disposal.

It is particularly focusing on high-quality office assets in best business districts (BBDs). The company’s diverse portfolio with top tenants in its roster and a robust balance sheet bode well for growth.

However, Highwoods faces intense competition from developers, owners and operators of office properties, as well as other commercial real estate, including sublease space available from its tenants. This restricts the company’s ability to attract and retain tenants at relatively higher rents than its competitors. It has significant exposure to office assets and interest-rate fluctuations. Huge development pipeline adds to operational risks.

Highwoods currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In addition, the stock has declined 1.6% year to date, underperforming the 4.3% gain of the industry it belongs to.

We now look forward to the earnings releases of other REITs like Condor Hospitality Trust, Inc. (NYSE:CDOR) , Boston Properties, Inc. (NYSE:BXP) and CyrusOne Inc (NASDAQ:CONE) . While Condor Hospitality Trust is scheduled to announce results on Aug 7, Boston Properties and CyrusOne are slated to report Q2 numbers on Aug 1 and Aug 2, respectively.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Highwoods Properties, Inc. (HIW): Free Stock Analysis Report

Boston Properties, Inc. (BXP): Free Stock Analysis Report

Condor Hospitality Trust, Inc. (CDOR): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Original post