The documentation of the endless march of asset markets higher has become passé; the illustration of the markets’ overvaluation redundant and tiresome. After years in which these same arguments have been made, without any discernable correction, the sober voices of warning have been discredited and discounted. The defenders of higher valuations have grown more numerous, more vocal, and more bulletproof.

I recently commented in a forum on cryptocurrencies…something to the effect that while I see blockchain as being a useful technology – although one which, like all technologies, will be superseded someday – I don’t expect that cryptocurrency in any of its current forms will survive because they don’t offer anything particularly useful compared to traditional money, and moreover have a considerable trust hurdle to overcome due to the numerous errors, scandals, and betrayals that have plagued the industry periodically since MtGox. Whatever you say about ‘traditional’ money, no one worries that it will vanish from your bank account tomorrow due to some accident. I don’t see anything particularly controversial about that statement, although reasonable people can disagree with my conclusion that cryptocurrency will never gain widespread acceptance. However, the reaction was aggressive and unabashed bashing of my right to have an opinion. I hadn’t even uttered an opinion about whether the valuation of bitcoin is a bubble (it obviously is – certainly there’s no sign of the stability you’d want in a currency!), and yet I almost felt the need to run for my life. The bitcoin folks make the gold nuts look like Caine in the TV show “Kung Fu”: the epitome of calm reasonableness.

But, again, chronicling the various instances of bubble-like behavior has also become passé. It will all make sense after it’s over, when the crowd recovers its senses “slowly, and one by one” as Mackay had it about 170 years ago.

Today though I want to address a quantitative error that I hope is hard to argue with. It has become de rigeur throughout this…let’s call it the recent stages of an extended bull market…to list all of the reasons that a continued rally makes sense. I always find this fascinating because such enumeration is almost never conducted with reference to whether these things are already “in the price.” On the weekend money shows I heard several pundits opine that the stock market’s rally was likely to continue because “growth is pretty good, at around 3%; interest rates are relatively low; inflation is relatively low; government has become more business-friendly, and wages seem to be going up again.” As I say, it seems to me that most of this should already be in the market price of most securities, and not a cause for further advance. But one of those items is in fact a bearish item.

Make no mistake, wages going up is a great thing. And it’s nice to hear that people are finally starting to note that wages are rising (I pointed this out in April of 2016, citing the Atlanta Fed’s macroblog article on the topic, here. But not everyone reads this column, sadly). The chart below shows the Atlanta Fed’s Wage Growth Tracker, against Median CPI.

So wages are going up for continuously-employed persons, and this is good news for workers. But it’s bad news for corporate earnings. Corporate margins have been very high for a very long time (see chart, source Bloomberg), and that’s partly because a large pool of available labor was keeping a lid on wages while weak global demand was helping to hold down commodity input prices.

Higher wages are, in fact, a negative for stocks.

The argument for why higher wages seem like they ought to be a positive for stocks goes through consumption. If workers are earning more money, the thinking goes, then they can buy more stuff from companies. But this obviously doesn’t make a lot of sense – unless the worker is spending more than 100% of his additional wages in consumption (which can happen if a worker changes his/her savings pattern). If a worker earns $10, and spends $9 buying goods, then business revenues rise by less than wage expenditures and business profits fall, all else being equal.

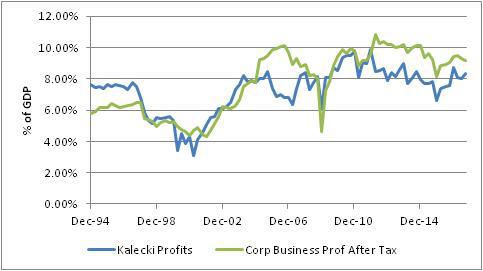

This shows up in the Kalecki profits equation, which says that corporate profits equal Investment minus Household Savings minus Government Savings minus Foreign Savings plus Dividends. (Look up Kalecki Profit Equation on Wikipedia for a further explanation.) Rearranging, Kalecki profits equal Investment, minus Government Savings (that is, surplus…so currently the deficit contributes to profits), minus Foreign Savings, plus (Dividends minus Household Savings). So, if workers save some of their new, higher earnings then corporate profits decline. The chart below shows how the Kalecki decomposition of profits tends to track pretty well with reported business profits (source: Bloomberg).

Now, profit margins have been high over the last year despite the rise in wages (not because of it) because the personal savings rate has been declining (see chart, source Bloomberg).

If wages continue to grow, and workers start to save more of their earnings (paying off credit cards perhaps?), then it means that labor is taking a larger portion of the pie compared to the historically-large portion that has been going to capital. This is good for workers. It is not good for stocks.