With oil prices breaching the USD80/b mark in recent weeks, markets and analysts are already taking stock of how different countries are being affected. Our analysis focuses on the effect of higher oil prices on the major Asian economies of China, India, Indonesia, Korea, Malaysia, the Philippines, Taiwan and Thailand.

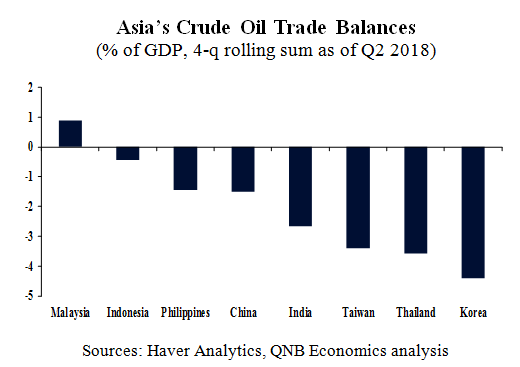

As Asia’s only net oil exporter, Malaysia is expected to benefit from oil windfalls. The country presents a surplus of c.140k barrels per day(b/d) and a positive crude oil trade balance of around 1% of GDP.

Higher export receipts from crude oil are not a game changer for Malaysia. The country holds structural current account surpluses. However, oil revenues are key for the country’s fiscal position. According to Malaysia’s economic authorities, every USD1/b increase in oil prices adds about USD72 million to government revenue. This is an important source of fiscal support for the newly elected reformist government, especially as government finances are under pressure by the recent repeal of the Goods and Sales Tax (GST) and the outlook for higher public debt. Government action to increase transparency in the public sector resulted in a sharp upward revision of the public debt from 54% to 75% of GDP.Additional oil revenues are therefore a vital tailwind for Malaysia’s fiscal balances.

Indonesia faces moderate challenges when it comes to oil prices. While higher oil prices boost up revenues and favour government finances, private consumption and investment are negatively affected.Despite domestic production of around 800k b/d of crude oil, Indonesia became a net importer last year. The deficit of c.190k b/d makes-up a small negative crude oil balance of 0.4% of GDP.As such, rising and higher oil prices add up to Indonesia’s overall current account deficit and contribute to the mounting external pressure the country is facing. In response, the government is trying to curb rising oil import bills by announcing plans to mix domestically produced biofuels into petrol.

Importantly, the 7.9% depreciation of the Rupiah so far in 2018 contributes to further amplify the positive effect of higher oil prices in fiscal balances and the negative effect in the private economy, as revenues in local currency increase and domestic fuel prices soar.

China, Taiwan, Thailand and Korea all have their oil trade balances in negative territory, ranging from 1.5% to 4.4% of GDP.However, sizable overall current account surpluses of close to 10%of GDP make Taiwan, Thailand and Korea extremely resilient, while China is supported by a positive current account surplus of nearly 1% of GDP and is not so vulnerable.

Asia’s Crude Oil Trade Balances (% of GDP, 4-q rolling sum as of Q2 2018)

Sources: Haver Analytics, QNB Economics analysis

A combination of current account deficits and substantially negative net oil positions are a rising challenge to the Philippines and India. Higher oil bills widen current account deficits and add to external vulnerabilities such as FX pressures. In the Philippines, an oil trade deficit of 1.5% of GDP amounts to the total size of the country’s current account deficit.A lack of substantial subsidies limits the effect of higher oil prices in fiscal balances, concentrating the impact on the private sector. This negative effect of higher oil prices in private sector discretionary spending is magnified by the 6.7% year-to-date depreciation of the Philippine Peso against the USD.

The high pass-through from international oil prices to domestic fuel prices in the Philippines is also contributing to the rising headline inflation. In September 2018, CPI inflation reached a 10-year high of 6.3% y/y, 330bp above the central bank target. In order to respond to that and help limit capital outflows, the Philippine Central Bank has lifted its policy rate by 150bp so far this year.

Like in the Philippines, the oil trade deficit in India is high at 2.7% of GDP, amounting to nearly the total size of the country’s current account deficit. In India, however, high fuel subsidies make the extended public sector shoulder considerable losses. According to Moody’s, fuel subsidies are expected to cost between USD4.6bn to USD7.2bn in 2018, against an initial budget of USD3.3bn.

As subsidies are concentrated on liquefied petroleum gas and kerosene,part of the private sector is still affected by higher domestic fuel prices. FX depreciation also plays an amplifying role here; the Indian Rupee is down 10.3% against the USD so far this year. This has been contributing to push headline inflation to the higher-end of the central bank target, which supports the Reserve Bank of India’s 50bp hike to contain mounting external pressure.

In short,higher oil prices are positive for Malaysia. Current account surpluses shelter China, Taiwan, Thailand and Korea, while Indonesia, the Philippines and India have to face more challenges associated with higher oil bills.