On September 20, the Federal Reserve confirmed a status quo, holding interest rates steady. Yet, they also hinted at another likely rate increase before the year's end, with fewer downward adjustments coming in 2024 than previously assumed.

This potential hike would cap a series of 11 adjustments since March 2022, placing the Fed funds rate between 5.25% and 5.5%—a peak not seen in over two decades.

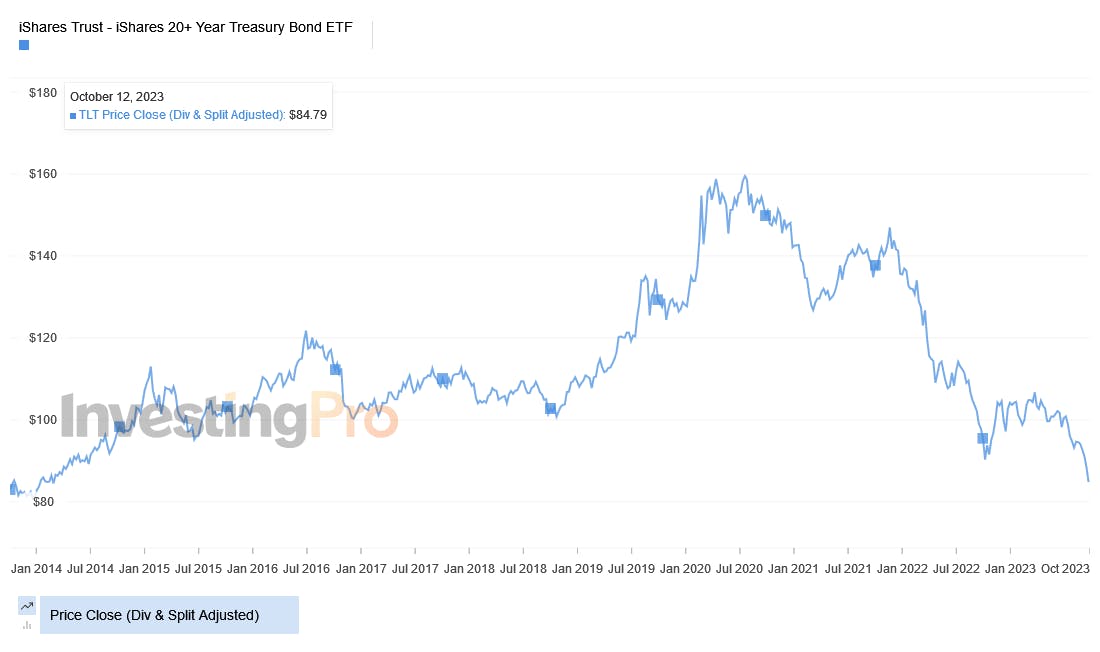

This trajectory, suggestive of an extended phase of lofty interest rates, has cast shadows on some ETFs. Long-term bond ETFs, previously viewed as stalwarts for diversification, have faltered.

Take the popular iShares 20 Plus Year Treasury Bond ETF (TLT), for example; it plummeted by 31.41% in 2022 and has shrunk by an additional -15.17% year-to-date as of October 12 putting it at levels unseen since 2014.

Source: Investing.com Pro

As expectations of a rate reduction fade, investors might need to reconsider their fixed-income allocations. Should talks of "higher rates for longer" mark a true departure from the Zero Rate Interest Policy (ZRIP) of the previous decade, a potential alternative emerges: floating rate bond ETFs.

Here's a look at several NYSE-listed options that stand out as potential refuges in these uncertain times.

A Brief Primer on Floating-Rate Bonds

Floating rate bonds, often simply called "floaters," aren't your usual bonds. Instead of paying a set interest, they pay interest that can change over time. How much interest you get depends on a common reference rate, like the 3-month treasury bill rate, with a little extra added on top called a spread.

One key feature of these bonds is they have a "low duration." Think of duration as a measure of a bond's sensitivity to changing interest rates. Bonds with a low duration aren't as affected by rate changes, so their prices don't move as much when rates go up or down.

They're especially handy when interest rates are going up. As these rates increase, the interest on floaters also goes up, potentially giving investors more earnings. On the other hand, regular bonds might lose value as newer bonds with better interest rates come into the picture.

And the best part? These floaters, like many other assets, can be grouped together and sold as a package to investors through an ETF wrapper. This makes it easier for everyday investors to add them to their portfolios.

Treasury Floating-Rate Note ETFs

Floating rate bonds, akin to their traditional fixed-rate siblings, come in various flavors. They can be issued by both governments and corporations. When the government is the issuer, particularly the U.S. government, we often refer to them as Treasury floating rate notes.

One of the standout features of these Treasury-issued floaters is their exceptional credit quality. Why? Simply because they're backed by the full faith and credit of the U.S. government.

Given the historical stability and robustness of the U.S. economy, the chances of the U.S. government defaulting on its obligations are incredibly slim. Investors often see these bonds as a relatively safe bet.

However, there's a trade-off. While Treasury floating rate notes offer high security, they tend to yield less in terms of interest compared to their corporate counterparts.

Corporations typically have to offer higher yields to attract investors, compensating for the increased risk compared to government-backed bonds. Thus, while Treasury floaters might offer peace of mind, they may come with the caveat of a lower return potential.

Two of the most popular NYSE listed Treasury floating rate note ETFs currently are:

- iShares Treasury Floating Rate Bond ETF (TFLO): 0.15% expense ratio, 5.62% average yield to maturity.

- WisdomTree Floating Rate Treasury Fund (USFR): 0.15% expense ratio, 5.56% average yield to maturity.

Investment Grade Floating Rate Bond ETFs

Stepping slightly beyond the ultra-secure realm of Treasury bonds, we find ourselves in the domain of investment grade floating rate bonds issued by corporations. A significant portion of these bonds emanate from the financial sector, encompassing entities like banks and insurance companies.

When we talk about "investment grade", we're referring to bonds that have been given a stamp of approval by leading rating agencies, such as Standard & Poor's. To be classified as investment grade, these bonds need a rating of BBB or higher. This rating essentially tells investors that the bond has a relatively low risk of default.

However, as with all things financial, there's a balance between risk and reward. While investment grade floating rate bonds carry a higher credit risk compared to the nearly impregnable U.S. Treasuries, they offer a silver lining: elevated yields.

In essence, by taking on a tad more risk, investors can expect to receive a better payout, making these corporate-issued floaters a tempting proposition for those seeking a blend of safety from rising rates and decent returns.

Two of the most popular NYSE listed investment grade floating rate bond ETFs currently are:

- SPDR Bloomberg Investment Grade Floating Rate ETF (FLRN): 0.15% expense ratio, 6.11% yield to maturity.

- VanEck IG Floating Rate ETF (FLTR): 0.14% expense ratio, 6.41% yield to maturity.

This content was originally published by our partners at ETF Central.