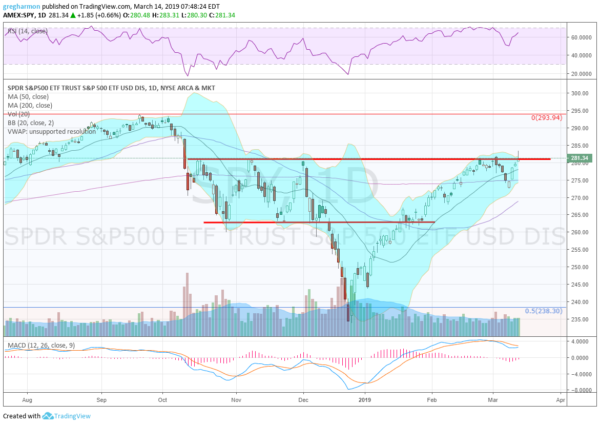

Wednesday the SPDR S&P 500 (SPY) made a major new high, closing above the November 7 high. This is the highest close since October 9, a 5-month closing high. What triggered this? The run from the Christmas Eve bottom has been significant, but that run with its ‘V’ bottom could be viewed as nothing more than a snapback rally.

Making a new higher high, over the full range from the October drop is the first step in a total recovery. It now has a foothold for an assault at the all-time high. Momentum is on its side with the RSI rising in the bullish zone and far from overbought. The MACD is positive and turning to cross up again.

Today is not a cause for a major party, but bulls will wake up with a little less sweat on their foreheads. It is a first major step in retaking the high. Have a peaceful celebration and watch for what is next.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.