Market movers today

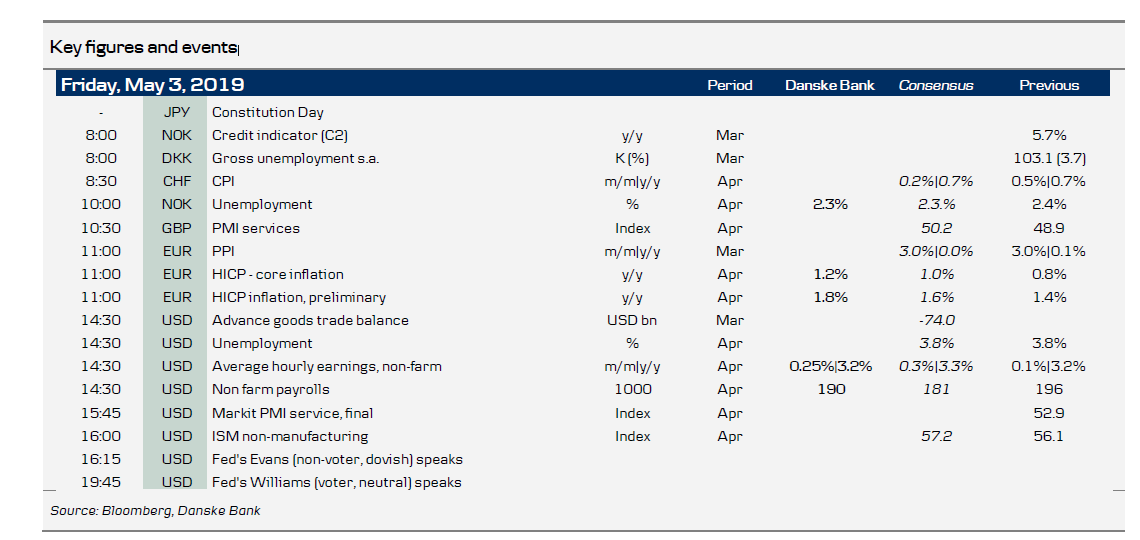

Today we have a number of important events, starting with the euro area inflation print, where we expect a decent rebound in both headline and core inflation to 1.8% y/y and 1.2% y/y, respectively, from last month's low levels driven by seasonal effects from the timing of Easter.

In the US, the jobs report is due out later in the day. Overall, the labour market remains strong, but we think it is important to keep an eye on whether employment growth starts to decelerate. We expect average hourly earnings to have risen +0.25% m/m in April, unchanged at 3.2% y/y. We expect nonfarm payrolls to have risen 190k.

Markets will digest the outcome of the UK local elections and whether it means something for May's premiership.

We have a lot of Fed speeches today, where we will look for any differences in views after this week's FOMC meeting.

In Scandinavia , we get Norwegian and Danish unemployment data for April (page 2)

Selected market news

In the UK, not all results in the local elections were declared yet but so far the trend is that voters are punishing the Conservative Party and Labour, with LibDems and independents gaining seats. EUR/GBP has moved a bit lower this morning. Turnout was low. Neither Farage's Brexit Party nor the remain party, The Independent Group/Change the UK, stood in the elections but they will in the European elections later this month, where polls suggest the Conservatives will suffer an even heavier defeat.

In line with expectations, the Bank of England (BoE) announced yesterday that the Bank Rate will remain at 0.75% and that it would still be appropriate to tighten monetary policy over the coming years. Our base case remains that the BoE is on hold for the next 12 months.

There is no stress in the oil market over the end to Iran sanction waivers. Yesterday, the Brent oil price fell below USD71/bbl, weighed down by a stronger USD and weak equity market sentiment. The US started drawing on SPR already last week, as yesterday's inventory figures showed a draw of 550kb last week. That has helped push oil prices lower. Copper is on course for its biggest weekly drop since August.

US President Trump tweeted yesterday that Stephen Moore had pulled his Fed candidacy despite Moore saying earlier that he was still "all in". The reason was his remarks about women. We believe it is positive that both of Trump's candidates have now pulled their candidacies. Economic research indicates that monetary policy is most efficient when it is independent from short-term political views and the risk was that they would not be so.

The EU's Juncker has called the Bundesbank's Weidmann a "suitable" candidate for succeeding Mario Draghi as ECB president.

Scandi markets In Norway, we expect registered unemployment to be unchanged at 2.3% (seasonally adjusted) in April. Economic growth and demand for labour both seem to be holding up, which should pave the way for further improvements in the jobless rate. On the other hand, more firms are reporting problems sourcing skilled labour, which will gradually cause the fall in unemployment to slow.

Fixed income markets

The expected surge in euro area inflation in April is most likely driven by seasonality effects due to the Easter holidays. Hence, the impact on the fixed income market should be modest. A strong jobs report, in particular if wage growth surprises to the upside, will support the Fed’s case to stay on hold and put modest upward pressure on US Treasury yields.

France is up for review by Moody’s. Moody’s currently has France on a positive outlook, but the French government has changed its fiscal stance. The more expansive fiscal budget has meant that the forecast for the French budget deficit in 2019 has been revised from -2.8% of GDP in early January to -3.2% of GDP currently. Any change in the outlook would be expected to be negative for French government bonds, and thus we maintain our long position in 5Y Spain versus France.

FX markets

The NOK weakened substantially yesterday from a combination of falling global inflation expectations post Fed, risk-off, lower oil prices, weaker-than-expected domestic data and stop-losses triggered. Fundamentally, we remain bullish on the NOK but the external post- Fed environment combined with short-term downside risks to domestic releases and next week’s dividend payouts from most notably DnB suggests a limited near-term downside potential in EUR/NOK. That said, our short-term financial regression model for EUR/NOK – which has a strong track record –- suggests a selling opportunity when momentum stabilises. We will look to utilise that.

In the majors, EUR/USD’s attempt at a comeback this week have faced headwinds after Wednesday’s FOMC meeting. Our call for US average hourly earnings to slightly disappoint consensus and for euro area inflation to come in high should help EUR/USD finish the week on a high note.

The GBP was essentially unchanged on the day after the BoE meeting. We keep firm our expectation of range-trading at 0.85-0.87 (roughly +/-1 percent band from the middle). The key to moving outside the band is likely (1) getting closer to realising some form of Brexit and/or (2) a significant change to the domestic economy. But both options remain elusive. In case of a resolution of the politics, the core BoE expectation and forecasts remain centred on a soft Brexit with a rebound in inflation and domestic demand. In turn, we think, this should help cap the immediate upside even if politics get resolved, as the central bank would not need to change much. In any case, the BoE would likely wait and see how the economy evolves ex-post a positive Brexit event.

The Danish FX reserves were almost unchanged in April as Danmarks Nationalbank refrained from intervening in the FX markets. More importantly, government deposits dropped DKK30bn to the lowest level in over 10 years. This can explain the rise in DKK excess liquidity, which pushed short-term DKK rates and EUR/DKK FX forwards even lower during April. For more details see Flash Comment.