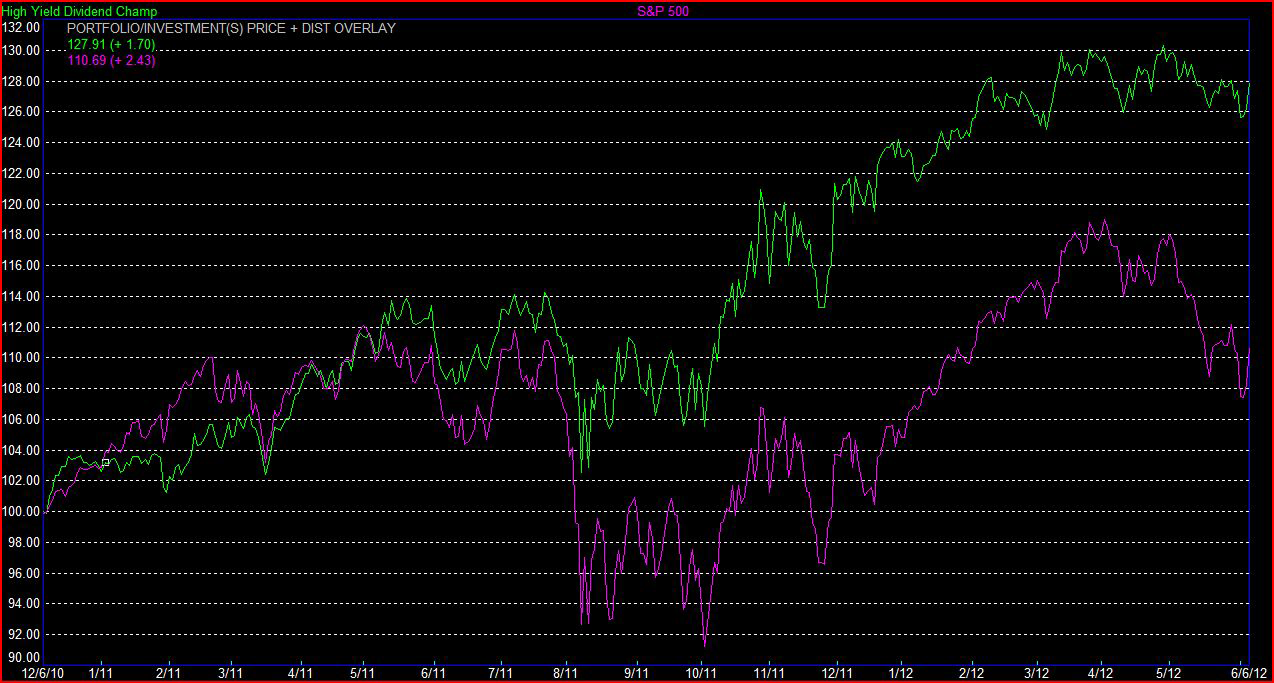

In December 2010, I created a screen/hypothetical portfolio called the “High Yield Dividend Champion Portfolio.” The screen is tracked publicly as a continuous hypothetical portfolio with a starting balance of $100,000 on Scott’s Investments (see the right hand column for a link to the spreadsheet).

Like many of the screens, strategies, and portfolios I track and prefer, this strategy takes a small number of historically relevant ideas, to create a simple, yet powerful action plan for the individual investor. As I have previously detailed,

Some studies have shown that the, highest yielding, low payout stocks perform better over time than stocks with higher payouts and lower yields.

This portfolio attempts to capture the best high yield, low payout stocks with a history of raising dividends. There are numerous ways to gauge the “best” high yield/low payout stocks. The list starts with the “Dividend Champions” as compiled by DRIP Investing. The list is comprised of stocks that have increased their dividend payout for at least 25 consecutive years

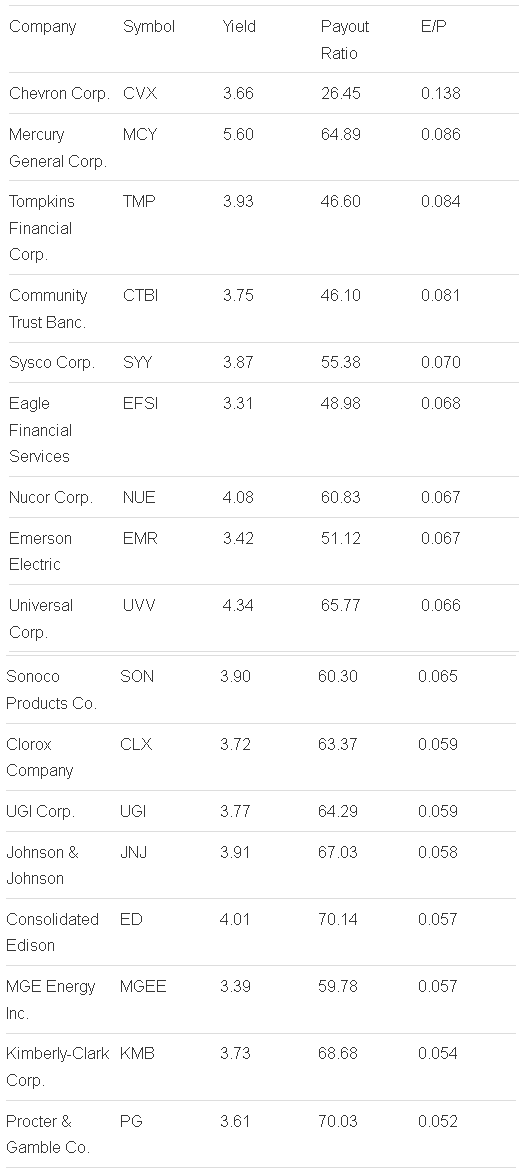

The Dividend Champions are the starting point and we first rank them based on yield. The highest 1/3 yielding stocks are kept and the rest are eliminated. With the remaining high yielding stocks we eliminate half with the highest payout ratio. The remaining stocks are then assigned a rank based on the ratio of their dividend yield to payout ratio (the same as a trailing earnings/price ratio, or the inverse of the trailing P/E ratio).

The top 10 stocks based on this ratio make the portfolio. Stocks will be sold at the re-balance date (generally around the 5th of the month) when they drop out of the top 12 (to limit turnover) and are replaced with the next highest rated stock.

For June 6th we are selling 212 shares of Consolidated Edison (ED), which was purchased at the portfolio inception over a year ago (12/6/2010) and sold for a capital gain of 15.34% (excluding dividends). The proceeds were used to purchased Nucor (NUE), which currently yields 3.97% and has a payout ratio of 61%.

In April the Dividend Champion Portfolio update stated “The technical analyst in me has seen momentum in US equities slow the past few weeks. This particular portfolio has returned over 27% since inception but now may be a time to temper expectations.”

May was a difficult month for equities and the forward technical picture for equities still looks precarious. The High Yield Dividend Champion Portfolio was designed to be fully invested at all times regardless of market conditions. However, as part of a larger portfolio there may be additional steps an investor can take to reduce risk and diversify strategies. Additional hedging or diversification techniques can serve to reduce risk but may also reduce potential capital gains.

For example, using Born To Sell we can explore potential covered call opportunities on stocks in the portfolio. At the time of writing last month the CVX June $105 calls had bid of $1.74 and the June $110 calls had a bid of $.38. With CVX now trading below $100 and option expiration next Friday, those calls have declined significantly in value. An investor could roll the covered calls on CVX by closing the existing position (the $105 strike at $.15 or the $110 at $.05) and selling a July 105 call for $.93 or a July 100 call for $2.98 (Quotes reflect today’s closing bid/asks).

The equity curve of the portfolio is plotted below and since inception it is up over 27%. All discussions of returns are strictly hypothetical and exclude commissions and taxes.

The top 17 rated stocks for the purposes of this portfolio’s criteria are listed below:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

High Yield Dividend Champion Portfolio For June

Published 06/07/2012, 05:20 AM

Updated 07/09/2023, 06:31 AM

High Yield Dividend Champion Portfolio For June

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.