In December 2010, I created a screen/hypothetical portfolio called the “High Yield Dividend Champion Portfolio.” The screen is tracked publicly as a continuous hypothetical portfolio with a starting balance of $100,000 on Scott’s Investments (see the right hand column for a link to the spreadsheet).

Like many of the screens, strategies, and portfolios I track and prefer, the High Yield Dividend Champion Portfolio uses a small number of historically relevant ideas to create a simple, yet powerful investment plan. As I previously detailed, “Some studies have shown that the, highest yielding, low payout stocks perform better over time than stocks with higher payouts and lower yields.”

The High Yield Dividend Champion Portfolio attempts to capture the best high yield, low payout stocks with a history of raising dividends. There are numerous ways to gauge the “best” high yield/low payout stocks. The screening process for this portfolio starts with the “Dividend Champions” as compiled by DRIP Investing. The list is comprised of stocks that have increased their dividend payout for at least 25 consecutive years.

Last month I announced some changes to the ranking system. The changes were not due to poor performance – the strategy has returned over 46% in the past two-plus years:

We still begin with the Dividend Champion list. The list is first sorted by yield and the lowest 50% yielding stocks are eliminated.

The remaining stocks are then assigned a rank based on their yield (the higher the yield the higher the rank), payout ratio (the lower the payout ratio the higher the rank), 3 year dividend growth rate, and 5/10 year Dividend Acceleration/Deceleration (5-year average increase divided by 10-year average increase). Extra weight is given to yield and payout ratio rankings.

The top 10 stocks based on the new ranking system make the portfolio. Stocks will be sold at the re-balance date (generally around the 5th of the month) when they drop out of the top 15 (to limit turnover) and are replaced with the next highest rated stock.

This month there are three new positions. Tompkins Financial (TMP) was sold for a gain of 2.82% (excluding dividends) with an original purchase date of 8/5/2011. Community Trust Bancorp (CTBI) was sold for a gain of 22.55% (excluding dividends) with an original purchase date of 4/6/2011. Questar (STR) was sold for a gain of 10.92% (excluding dividends) and was just purchased on 1/7/2013.

Proceeds from the sale were used to purchase 599 shares of 1st Source (SRCE), 269 shares of American States Water Company (AWR) and 156 shares of Air Products & Chemicals (APD). Eagle Financial Services (EFSI) was actually ranked higher than SRCE; however, given the low trading volume of EFSI I have decided to exclude it from the list going forward.

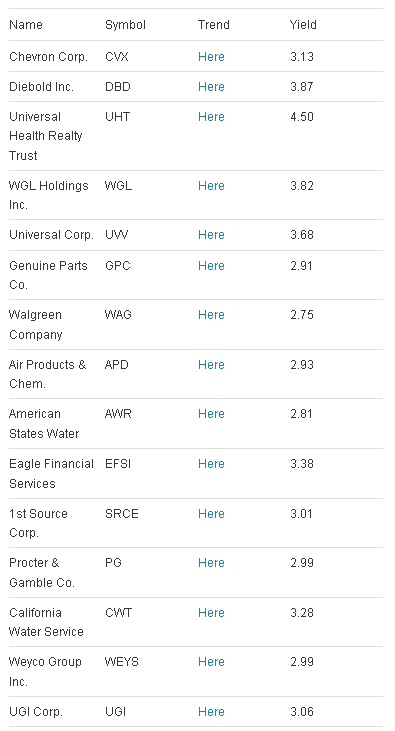

The top 15 stocks based on the new ranking methodology are below and displayed in order of their ranking:

Disclaimer: Stock Loon LLC, Scott's Investments and its author is not a financial adviser. Stock Loon LLC, Scott's Investments and its author does not offer recommendations or personal investment advice to any specific person for any particular purpose. Please consult your own investment adviser and do your own due diligence before making any investment decisions. Please read the full disclaimer at the bottom of www.scottsinvestments.com

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

High Yield Dividend Champion Portfolio For February

Published 02/06/2013, 04:23 AM

High Yield Dividend Champion Portfolio For February

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.