The Debt Markets are beginning to flash multiple warnings that “all is not well.”

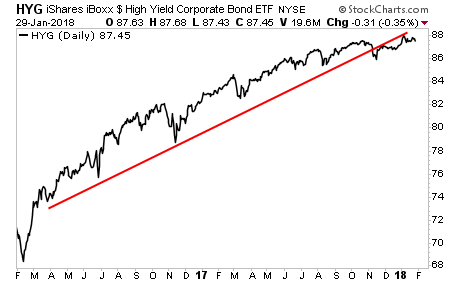

High yield credit, also called Junk Bonds, leads stocks and most risk assets to the upside. With that in mind, consider that the High Yield Credit ETF (NYSE:HYG) has broken its uptrend from the 2016 bottom.

This is a MAJOR warning that the “risk on” move of the last few months is stalling out if not preparing for a correction.

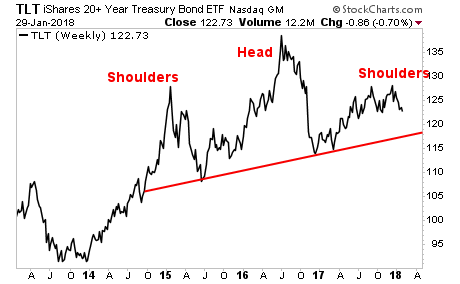

Similarly, the long-term Treasury ETF (NASDAQ:TLT) peaked in mid-2016 and is now significantly down, carving out a clear Head and Shoulders topping pattern.

Why are these bonds beginning to roll over?

Because inflation is rising, and bond yields are rising to adjust to this reality.

When bond yields rise, bond prices fall.

When bond prices fall, the Bond Bubble begins to burst bursting.

Globally the world has added over $60 trillion in debt since 2009… and all of this was based on interest rates that were close to or even below ZERO.

All of this is at risk of blowing up as rates continue to rise. The time to prepare for this is NOW before things blow up.