Originally Published August 3, 2020

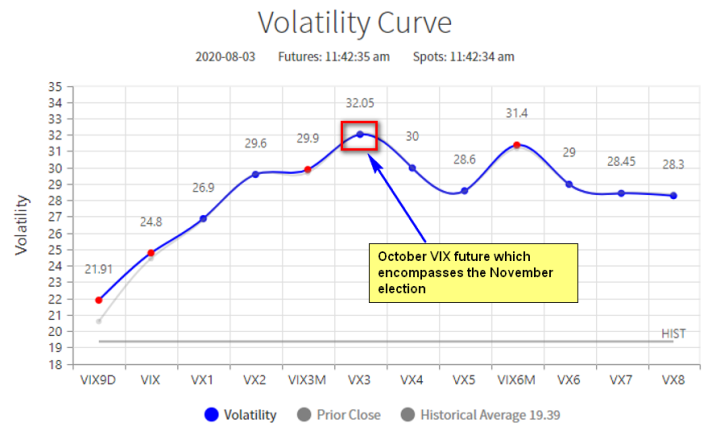

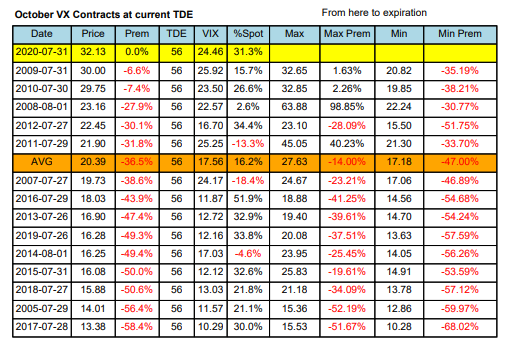

It is very hard not to notice how high the October VIX Futures is. At more than 32, this is the highest recorded reading with 56 trading days to expiration. This October VIX future (VX3 in the chart below) which expires on October 21st, 2020 is the VIX future represents the SPX options that include the November 3rd US Presidential election. It is about 7 points higher than the current VIX which is around 25. Clearly, option markets are more worried about the stock market 3 months out than ever before and the question is how much of this worry is the election and how much the high valuations of the market itself?

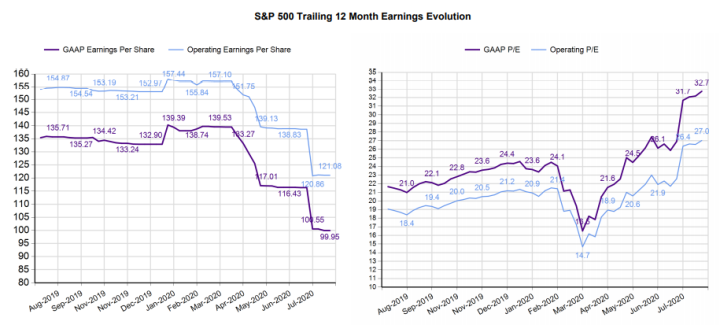

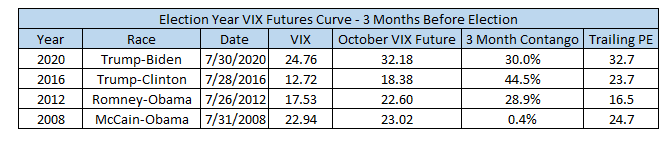

To figure out what is happening, I looked at valuations and VIX futures curve configurations with 3 months before the election in the years of 2016, 2012 and 2008 for which there is VIX futures data. Valuations and volatility are closely related - the higher the disconnect between fundamentals and prices, the higher the volatility as investors become active and sell for rebalancing or other profit taking reasons. VIX is around 25 now because SPX earnings have collapsed -28% from about $139 GAAP EPS in February to $100 GAAP EPS without a matching drop in stock prices. As result the Trailing 12 Month SPX PE multiple has increased from 24 to 32 – more than third. 32 multiple also happens to be the highest multiple 3 months before an election in the data set below. It is thus not a surprise that the VIX is currently the highest in the set. In fact, spot VIX now is in line with July 2008 when the US economy was last in recession.

Presently the October VIX future is about 30% higher than the current spot VIX. This is not a record high premium for an election year. Hedging markets were much more worried about the 2016 election with the then unexpected Trump candidacy. Many hedge fund managers warned about epic market collapse in 2016 and not only did they warn, they paid big option premiums to hedge for a Trump win. Their fears, of course, never came to fruition. The current election premium in the October VIX future is similar to the one in 2012 when Romney ran versus Obama. Neither Romney nor Obama was viewed as particularly damaging for the economy. Oddly, in 2008, in the middle of the recession hedgers weren’t much worried about the election, perhaps because the VIX was already pretty high at 22 so they didn’t think an additional premium was necessary.

In conclusion, it appears that hedging markets are much more worried about high valuations than they are about the Presidential election. As such, if market fundamentals don’t improve meaningfully, the high volatility levels we have observed so far in 2020 will continue even after the election.