The share price of Hibbett Sports Inc. (NASDAQ:HIBB), a relatively small sporting goods retailer with just over 1000 stores in the United States, fell to as low as $9.40 in mid-August 2017. During the following six months, however, the stock climbed to as high as $26.25 a share for a total return of 179%.

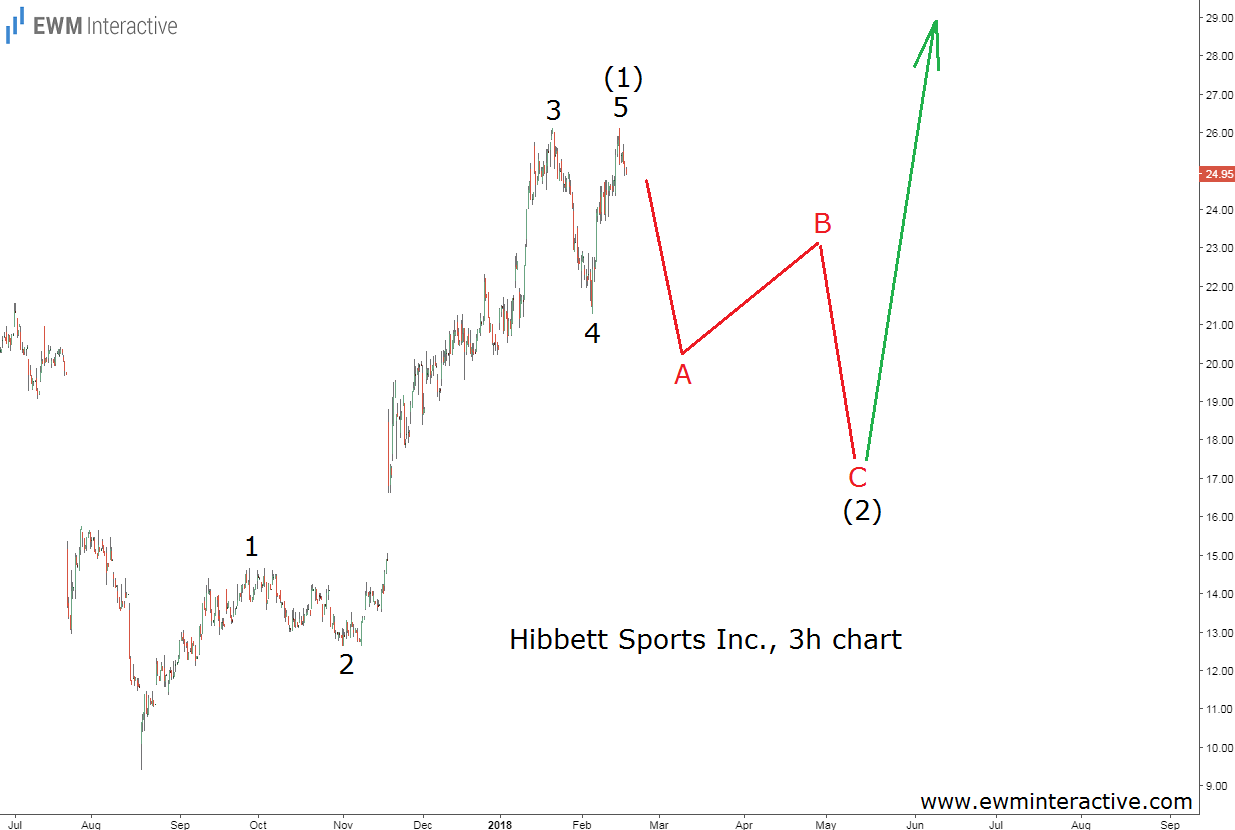

Given the big picture Elliott Wave outlook we shared with you on August 1st 2017, this sharp bullish reversal was not a surprise and we believe the stock has the potential to rise much higher in the long-term. The short-term perspective, on the other hand, might be a little disappointing and that is why we will focus on it in this article. The chart below allows us to sneak a peek at Hibbett stock’s rally from the bottom at $9.40.

As visible, the recovery to $26.25 looks like a textbook five-wave impulse, labeled 1-2-3-4-5. According to the Elliott Wave Principle, this means the crash is over and Hibbett stock is in an uptrend again. The bad news is that we should not expect the price to go straight up, because the theory also states that every impulse is followed by a three-wave correction in the other direction. In other words, Hibbett stock might lose roughly 30% in wave (2), before the uptrend resumes.

Instead of panicking and giving up on it, we believe long-term investors should take advantage of the anticipated weakness in Hibbett stock as the underlying company remains a profitable, debt-free business that is still growing. If this count is correct, the worst of the so-called retail crisis is finally over for Hibbett Sports.