Retail earnings are in full swing, with sporting goods retailer Hibbett Sports Inc. (NASDAQ:HIBB) set to unveil its fourth-quarter results ahead of the open tomorrow, March 22. HIBB stock is pacing for its third straight loss in the lead up to earnings, down 4.2% today at $17.77, after Consumer Edge Research downgraded the name to "equal weight" from "overweight."

History suggests HIBB shares could extend this negative momentum in tomorrow's trading, too. Hibbett Sports stock has closed lower the day after earnings in five of the last eight quarters, averaging a single-session loss of 10.8%. This time around, the options market is pricing in a 13.8% move, regardless of direction.

Amid low absolute volume, options traders have shown a preference for long calls over puts in recent weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 2.2 calls have been bought to open for each put in the last 10 sessions.

It's possible these call options are being used by short sellers to hedge against any upside risk. Short interest on HIBB edged higher in the most recent reporting period to 4.41 million shares -- a notable 24.4% of the stock's available float, or 15.9 times the average daily pace of trading.

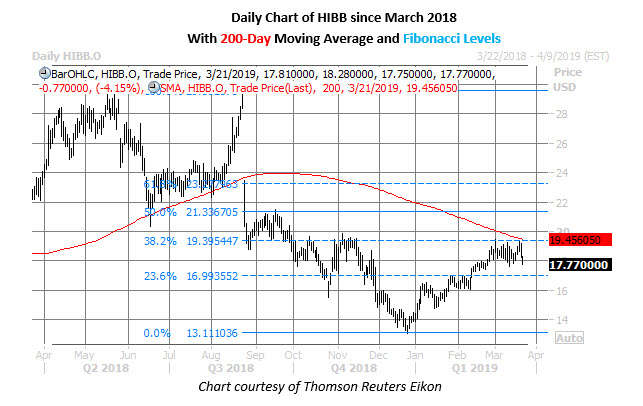

Looking closer at the charts, Hibbett Sports stock sold off sharply after hitting an annual high of $29.60 on Aug. 23, due largely to a 30.2% post-earnings plunge the very next day. The shares eventually bottomed at a 13-month low of $13.08 on Dec. 24. HIBB recently rallied all the way back up to $19.50 -- a 38.2% Fibonacci retracement of its late-2018 sell-off, and its 200-day moving average -- but is now mired in that three-day losing streak.