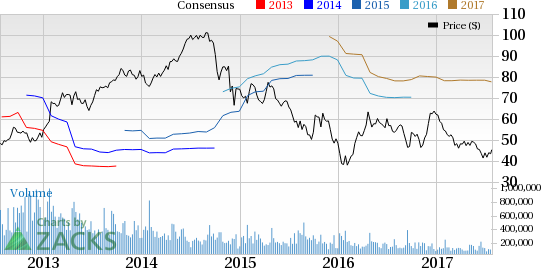

Hess Corporation (NYSE:HES) reported adjusted second-quarter 2017 loss from continuing operations of $1.46 per share, which is wider than the Zacks Consensus Estimate of a loss of $1.32. The reported figure was substantially wider that the loss of $1.29 in the year-ago quarter, attributed to the plunge in gas prices.

Revenues plunged more than 3% year over year to $1,228 million from $1,269 million. However, the top line surpassed the Zacks Consensus Estimate of $1,192 million.

Second-Quarter Operational Performance

In the reported quarter, the company’s Exploration and Production (E&P) business incurred adjusted loss of $354 million, narrower than the year-earlier loss of $328 million.

Quarterly hydrocarbon production totaled 300 thousand barrels of oil equivalent per day (MBOE/d), down 4.2% year over year.

Crude oil production was 177 thousand barrels per day compared with 179 thousand barrels per day in the year-ago quarter. Natural gas liquids production totaled 42 thousand barrels against 44 thousand barrels a year ago. Natural gas output was 487 thousand cubic feet (Mcf) compared with 539 Mcf in the prior-year quarter.

Worldwide crude oil realization per barrel of $45.95 (including the impact of hedging) increased 9.5% year over year. Worldwide natural gas prices plummeted 10.9% year over year to $3.19 per Mcf.

Financials

Quarterly net cash flow from operations was $165 million at the end of the quarter. Hess’ capital expenditures increased 9.1% to $528 million from $484 million in the prior-year quarter.

As of Jun 30, the company had approximately $2,492 million in cash and $6,612 million in long-term debt. The debt-to-capitalization ratio at the end of the quarter was 30.2%.

Zacks Rank

Currently, Hess carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the same space include Enbridge Energy, LP (NYSE:EEP) , Braskem S.A. (NYSE:BAK) and TransCanada Corp (TO:TRP) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enbridge Energy delivered a positive earnings surprise of 128.57% in the preceding quarter. The company beat estimates in three of the trailing four quarters with an average positive earnings surprise of 38.22%.

Braskem delivered a positive earnings surprise of 107.79% in the quarter ending September 2016.

TransCanada delivered a negative earnings surprise of 7.58% in the preceding quarter. It surpassed estimates in two of the trailing four quarters with an average positive earnings surprise of 1.06%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Hess Corporation (HES): Free Stock Analysis Report

Original post